Understanding Multimodal AI Complexity Businesses commonly use the term “multimodal”...

Read MoreNext-Level Insurance: Embracing the Future of Insurance with AI Adoption

Table of Contents

ToggleArtificial Intelligence (AI) has been revolutionizing various sectors, and the insurance industry is no exception. With its potential to streamline processes, enhance accuracy, and improve customer experiences, AI has become a significant driving force in the insurance sector. According to the latest studies. Insurance industry cost savings from AI will grow 𝗳𝗿𝗼𝗺 $𝟯𝟰𝟬 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 𝗶𝗻 𝟮𝟬𝟭𝟵 𝘁𝗼 $𝟮.𝟯 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 𝗯𝘆 𝟮𝟬𝟮𝟰.

Find out how papAI can improve the deployment of AI projects in the Insurance Sector here.

In this article, we will explore together the challenges of AI adoption in the insurance sector, its benefits, challenges, successful integration strategies, and future prospects.

AI's Adoption Overview in Insurance Industry

Insurers around the world are turning to AI to cut costs, boost sales and improve service efficiency. From helping predict customer needs to detecting fraud in real-time and predicting claims values, AI is powering insurers all along the insurance value chain. According to the International Data Corporation, spending on cognitive and AI systems will reach US$77.6 billion in 2022 with a significant amount of that investment directed to conversational AI applications such as chatbots and deep learning and machine learning applications. These investments are anticipated to save auto, property, life, and health insurers close to US$1.3 billion while also accelerating claim resolution and fostering stronger client relationships.

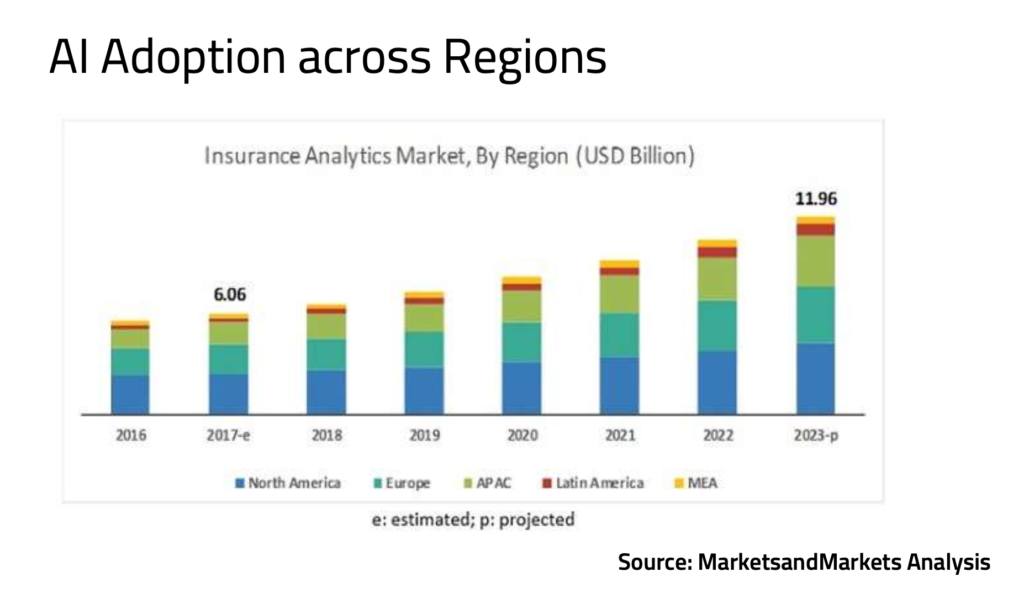

AI Adoption Across Regions

North America holds the largest share of the insurance analytics market, as it remains the largest insurance market by premium in addition to early adoption of technology advancements and analytics.

The US and Canada are expected to be the major revenue contributors in the North American insurance analytics market. Most of the insurance analytics vendors, including major players, have a direct or indirect presence in this region through SIs, distributors, and resellers.

The APAC region is expected to grow at the fastest rate in the global insurance analytics market during the period 2020-2023, due to its growing technology adoption rate.

Rapid economic developments, globalization, digitalization, and the increased adoption of cloud-based technologies are expected to drive the insurance analytics market in the APAC region.

Insurance AI Implementation Challenges

Since AI is still a young technology, there is considerable skepticism regarding its potential to enhance the relationship between insurance firms and their clients. The insurance sector is having some difficulty understanding and utilizing digital innovations. Here are some of the main obstacles that the world’s leading insurance companies have encountered when adopting AI:

1- Digital Capabilities Fall Short of Digital Objectives

Insurance companies seeking to experience possible advancements in their digital goals have not been successful in achieving the anticipated outcomes on a stage of global digital leadership. Some of them acknowledge coming close to the goal, but only 10% of them claim to have implemented digital reforms.

2- Much Resistance to Change

Legacy processes, basic technology, a non-innovative approach, slow delivery, and other internal restrictions are a few of the drawbacks that prevent the integration of all things digital. To identify prospective future business possibilities and their distinct potential for steady growth, insurance businesses still need to get over their uncertainty and reluctance towards digital intelligence.

3- Skills Gap

Professionals with the necessary training who can create, install, and manage AI systems are needed to implement AI in the insurance sector. However, there is now a scarcity of AI talent. In order to close the skills gap and provide their staff with the necessary knowledge, insurance companies must invest in training initiatives.

4- Increasing cost & competitive pressure, and consumer expectations

Despite insurance CEOs are aware of the industry-wide herald of digital disruption, but keeping up with these revolutionary changes and understanding them beyond the simple adoption of new technology will present a whole new set of challenges. Intelligent solutions must be sufficiently creative to improve customer relationships and provide customer experience in a way that inspires the crucial equilibrium between nascent market expectations and cost optimisation.

Successful AI Adoption Strategies

Companies should take into account the following measures to enable a successful integration of AI in insurance operations:

1- Establishing Clear Objectives

A crucial first step in successfully integrating AI into insurance operations is the establishment of defined objectives. It entails formulating precise objectives and results that complement the overarching business strategy. Insurance businesses may concentrate their efforts, manage resources wisely, and assess the effects of adopting AI by defining defined objectives.

When developing clear objectives for AI deployment in the insurance business, it is vital to consider many critical issues. First, identifying specific use cases is essential. This involves identifying areas within insurance operations where AI can add the most value, such as underwriting, claims processing, or customer service. Insurance businesses may focus their efforts on the areas that stand to gain the most from AI technology by focusing on a few key use cases.

Another crucial aspect of defining clear objectives is comprehending the demands of the organisation. It requires conducting a thorough analysis of existing processes and identifying pain points and inefficiencies that AI can address. By recognising these demands, insurance businesses may design objectives that directly target areas for improvement and optimization.

2- Ensuring Sufficient Data Availability

In order to properly use AI in the insurance industry, it is essential to have access to enough data. AI algorithms rely on vast amounts of data to train models, make accurate predictions, and generate meaningful insights. To assure data availability, insurance firms should examine the following aspects:

Data Integration and Collection: Insurance businesses must set up reliable procedures for gathering and combining pertinent data from multiple sources. In addition to external data like market trends, economic statistics, and social media data, this may also comprise internal data like client profiles, claim histories, and policy information. Insurers may acquire a complete and holistic understanding of their operations and the external issues affecting their business by gathering and combining data from many sources.

Data Cleansing and Quality: Ensuring data quality is crucial for reliable AI outcomes. Insurance businesses must engage in data cleansing techniques to eliminate any mistakes, duplication, or missing information. To preserve the data’s integrity, periodical data quality checks should be carried out. Additionally, implementing data governance practices and data quality standards can help ensure data accuracy and consistency across the organization.

Data Security and Privacy: Insurance companies deal with sensitive client information, making data security and privacy vital issues. Implementing robust data security measures, including encryption, access controls, and secure storage, helps protect customer data from unauthorized access or breaches. To maintain customer trust and ensure legal compliance, compliance with data protection regulations, such as GDPR or HIPAA, is essential.

3- Investing in Employee Training

A key component of effectively using AI technology in the insurance sector is investing in staff training. Insurance businesses must ensure that their staff members have the skills and knowledge required to collaborate productively with AI systems as AI continues to restructure the workforce and change company processes. When spending money on employee training for AI integration, keep the following important factors in mind:

AI Awareness and Demystifying: Education and Awareness of AI Start by raising awareness among staff members and teaching them about AI and its possible effects on the insurance sector. Offer training sessions, workshops, or online courses that cover the fundamentals of AI, its uses, and the advantages it can have. This promotes a positive attitude towards working with AI technologies and aids employees in understanding the justification for AI integration.

Skill Assessment and Gap Analysis: Perform a skill assessment to pinpoint the workforce’s current abilities and knowledge gaps. Determine the particular skills and competences required to operate successfully in those positions and departments by assessing which jobs and departments will be most impacted by AI integration. This analysis helps adapt training programs to meet specific skill shortages and ensure that staff are equipped with the correct competence.

Favorable learning environment.: Create a supportive learning environment where staff members are encouraged to explore and experiment with AI technologies. Encourage innovation, value learning from mistakes, and give staff members chances to put their newly acquired skills to use in practical situations. Employee confidence is increased, information exchange is encouraged, and the adoption of AI inside the company is accelerated in this context.

How to choose the best AI solution for your data project?

In this white paper, we provide an overview of AI solutions on the market. We give you concrete guidelines to choose the solution that reinforces the collaboration between your teams.

4- Consider Scalability and Future Growth

Scalability and potential future expansion are crucial factors to take into account when implementing AI into the insurance sector. The ability of AI systems and processes to handle growing volumes of data, users, or transactions without compromising performance or efficiency is referred to as scalability. Considering how AI integration can develop and adjust to changing business needs and technological advancements is necessary for future growth. Consider the following important factors when considering scaling and future growth:

Infrastructure and Resources: Check the current setup to see if it can accommodate scalable AI integration. To process and analyse large amounts of data, it is necessary to evaluate the computing power, storage capacity, and network capabilities needed. Think about whether you’ll need to upgrade your IT system, add more hardware, or use cloud computing to handle future growth in AI capabilities.

Aligning the AI integration plan with the organization’s overall business strategy and long-term objectives. Take into account how AI may assist with future business growth, new product offers, or enhanced consumer experiences. Continue to evaluate how AI initiatives fit with business goals to make sure that scaling and future growth efforts are consistent with the overall organisational vision.

How papAI Solution can help you better adopt AI

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

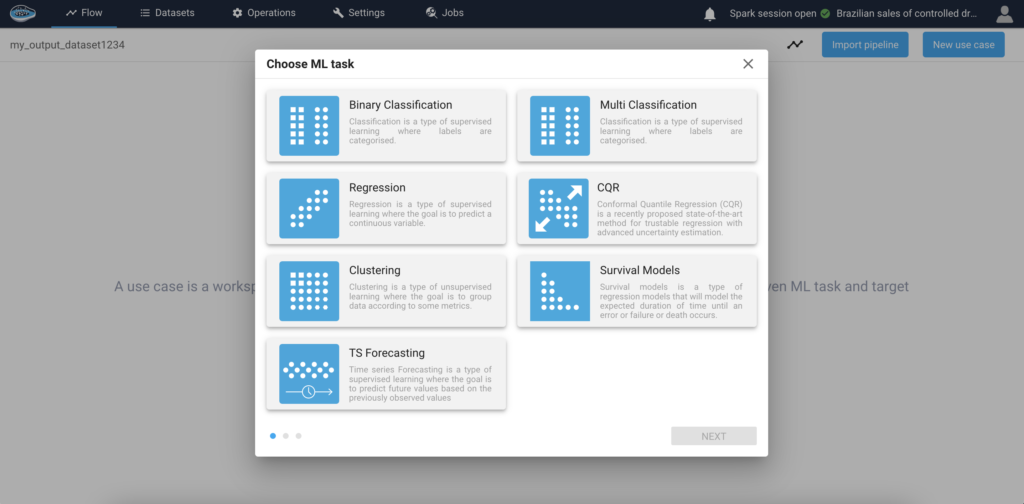

1- One-Step Model Deployment

The deployment of machine learning models is greatly streamlined by papAI Solution’s use of the Model Hub. The Model Hub serves as papAI’s main repository for pre-built, deployment-ready models. Because of this, companies are no longer need to build their models from start. Our most recent survey shows that, on average, papAI solution customers spend 90% less time developing AI applications.

A range of pre-trained models in many different domains, including image classification, Time series forecasting, and regression, are available through the Model Hub. These models have undergone rigorous training and validation processes and have been created by AI professionals to ensure their quality and performance.

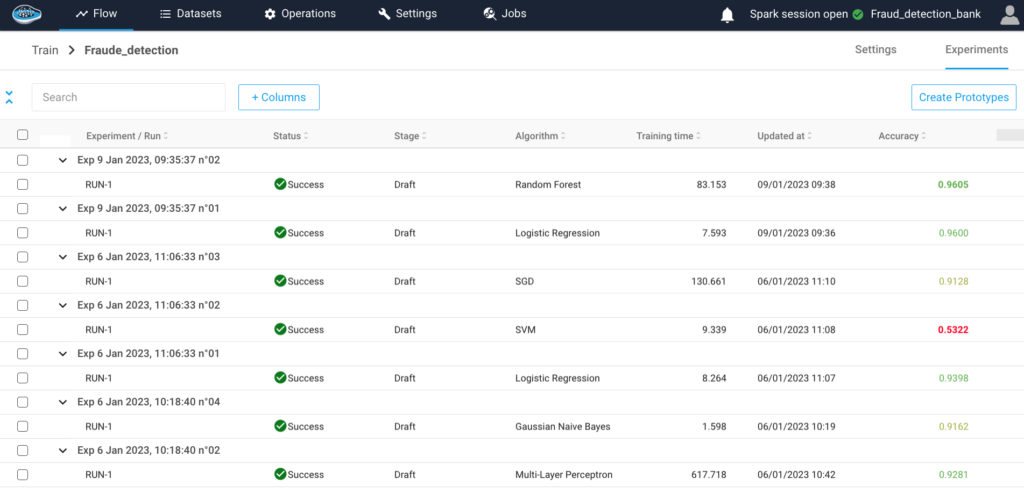

2- Efficient Model Monitoring

In order to guarantee the best performance and dependability of machine learning models in production situations, effective model monitoring is essential. Due to the significance of this aspect, papAI offers a variety of tools and features that are intended to increase the effectiveness of model monitoring.

papAI Solution offers extensive monitoring tools that let businesses maintain tabs on the most important model performance indicators in real time. Users may analyse the model’s performance and discover any probable flaws or deviations by keeping a watch on metrics like accuracy, precision, and other essential signals. This continuous monitoring enables preemptive identification of any decline in model performance, which is necessary to maintain high-quality outputs. Several clients have had confirmed accuracy of up to 98%.

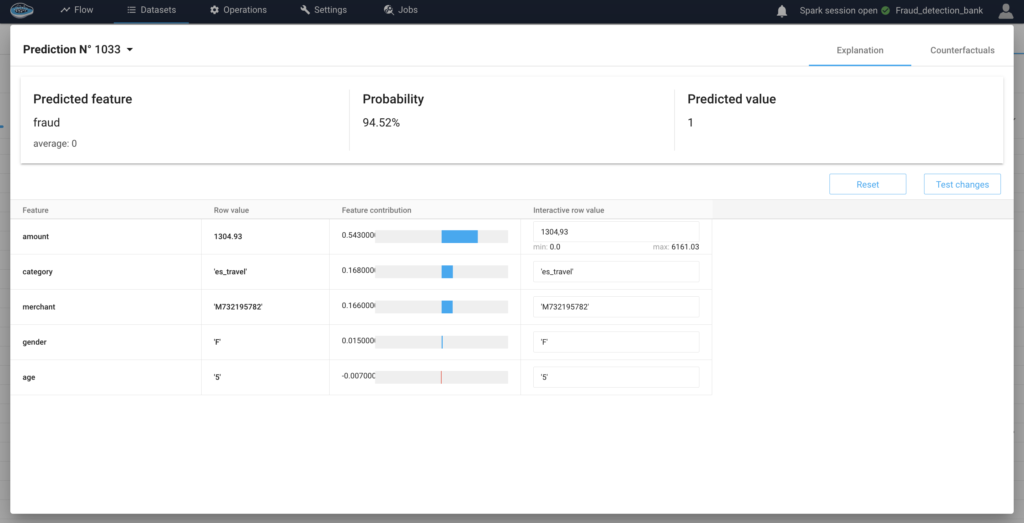

3- Improved Model Interpretability and Explainability

It has historically been challenging to understand how deep learning and complex machine learning models make their predictions because they are frequently viewed as “black boxes.” The papAI solution addresses this issue head-on by offering state-of-the-art techniques for model explainability. It reveals the inner workings of the models and highlights the vital components and traits that have a bearing on projections. With papAI, stakeholders can now see exactly how AI models make decisions, solving the enigma of how they anticipate the future.

Create your own AI-based tool with papAI solution to meet your specific needs

In conclusion, organizations of all sizes are finding that there is an increasing need to use AI-based technologies and insurance is one of them. Companies can create their own AI-based tools that are tailored to their needs using the papAI solution. This could lead to improved decision-making by business teams and increased profitability.

papAI is an effective solution that may greatly improve your company’s capacity to implement AI. papAI provides a wide variety of AI-related activities, from data preparation through model building, integration, decision-making, customer experience, monitoring, and analytics. Insurance firms can expedite the adoption of AI, increase operational effectiveness, and realize the full potential of AI technology to meet their business objectives by utilizing papAI.

Book your demo now. Our team of experts can help you create a custom AI-based tool that meets the unique needs of your organization.

Interested in discovering papAI?

Our commercial team is at your disposal for any questions

How Do AI Predictive Models Estimate Car Prices?

How Do AI Predictive Models Estimate Car Prices? Valuation methods...

Read More“DATATEGY EARLY CAREERS PROGRAM” With Tommy GUYOT

“DATATEGY EARLY CAREERS PROGRAM” With Tommy GUYOT Hello! My name...

Read More