-

Unlocking AI's Potential in Real-World Insurance SectorSCHEDULE LIVE DEMOpapAI offers a comprehensive, end-to-end platform that masterfully covers the entire spectrumAccuracy on95%93%Accuracy on

Unlocking AI's Potential in Real-World Insurance SectorSCHEDULE LIVE DEMOpapAI offers a comprehensive, end-to-end platform that masterfully covers the entire spectrumAccuracy on95%93%Accuracy on from data collection & cleansing to the seamless deployment of advanced machine learning models80%Claims Fraud91%Optimizationfor Insurance UnderwritingChurn PredictionDecrease inAI Deployment TImeDetection

from data collection & cleansing to the seamless deployment of advanced machine learning models80%Claims Fraud91%Optimizationfor Insurance UnderwritingChurn PredictionDecrease inAI Deployment TImeDetection

AI Revolution in Insurance: Transforming Underwriting, Claims, and Customer Service (Accenture)

A recent survey conducted by Accenture reveals that an impressive 63% of insurance companies have already integrated artificial intelligence (AI) into their operations. AI has found its foothold in several key areas within the insurance sector, underwriting, Claims processing, Fraud detection, and Customer services.

The AI Platform Built for Your Industry

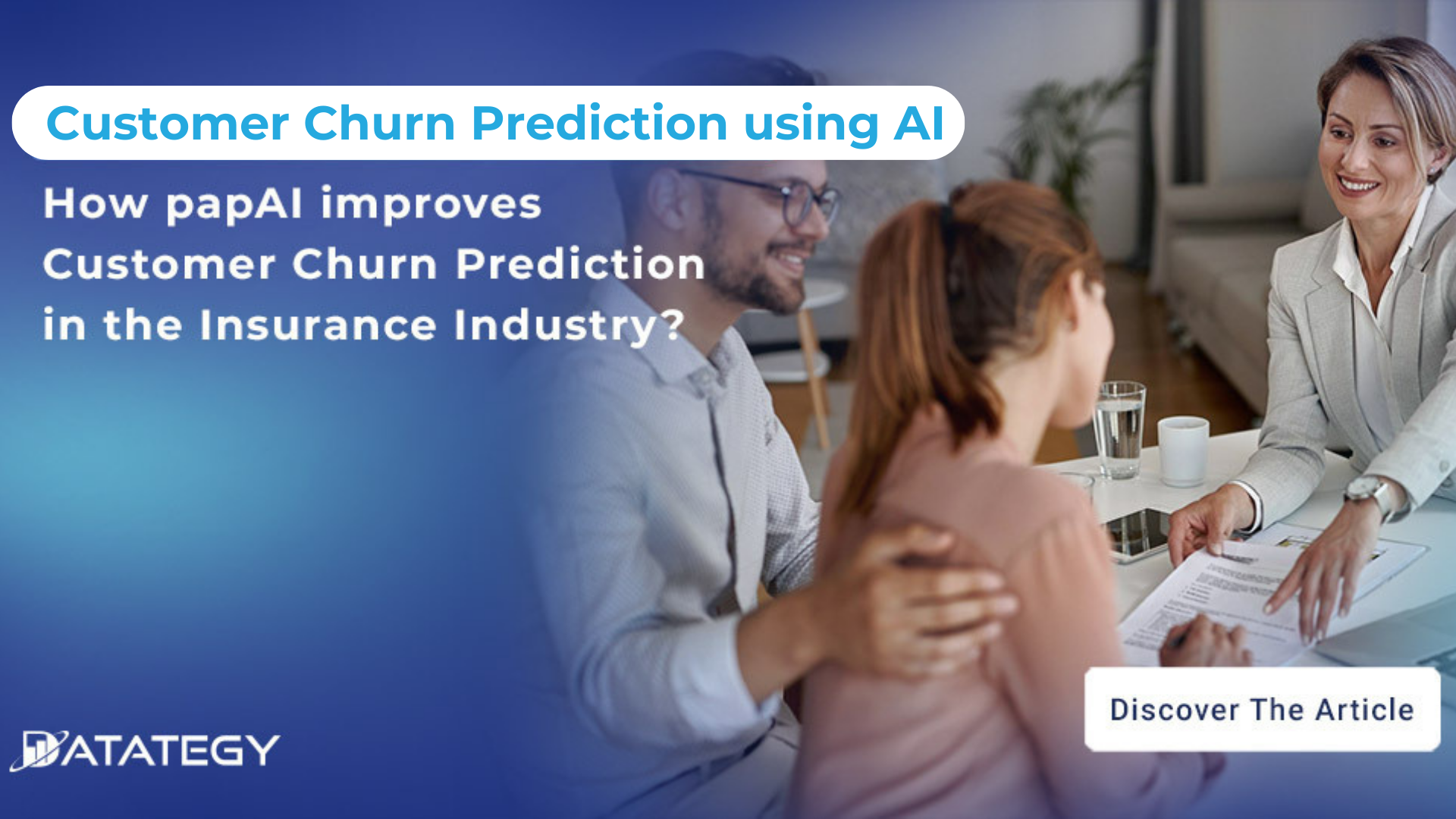

Customer Churn Prediction

papAI allows insurance companies to segment their customer base based on various attributes like demographics, transaction history, and customer preferences. This segmentation enables personalized retention strategies for different customer groups.

The platform employs predictive analytics to forecast potential churn by analyzing various factors such as customer engagement, complaints, and account activities. Banks can leverage these predictions to intervene before customers decide to leave.

papAI generates automated action plans based on churn predictions. These plans include recommended actions and strategies to retain at-risk customers

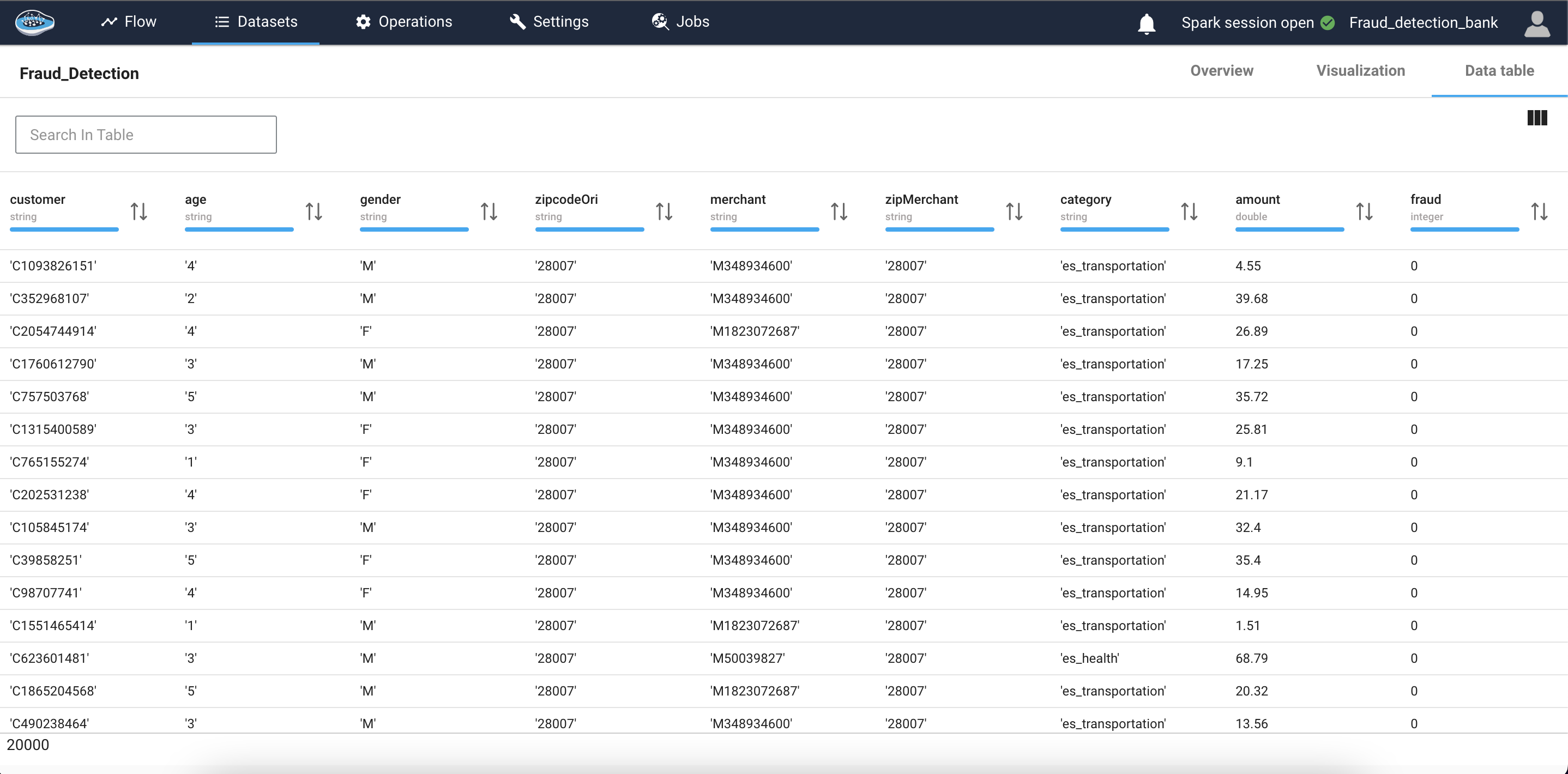

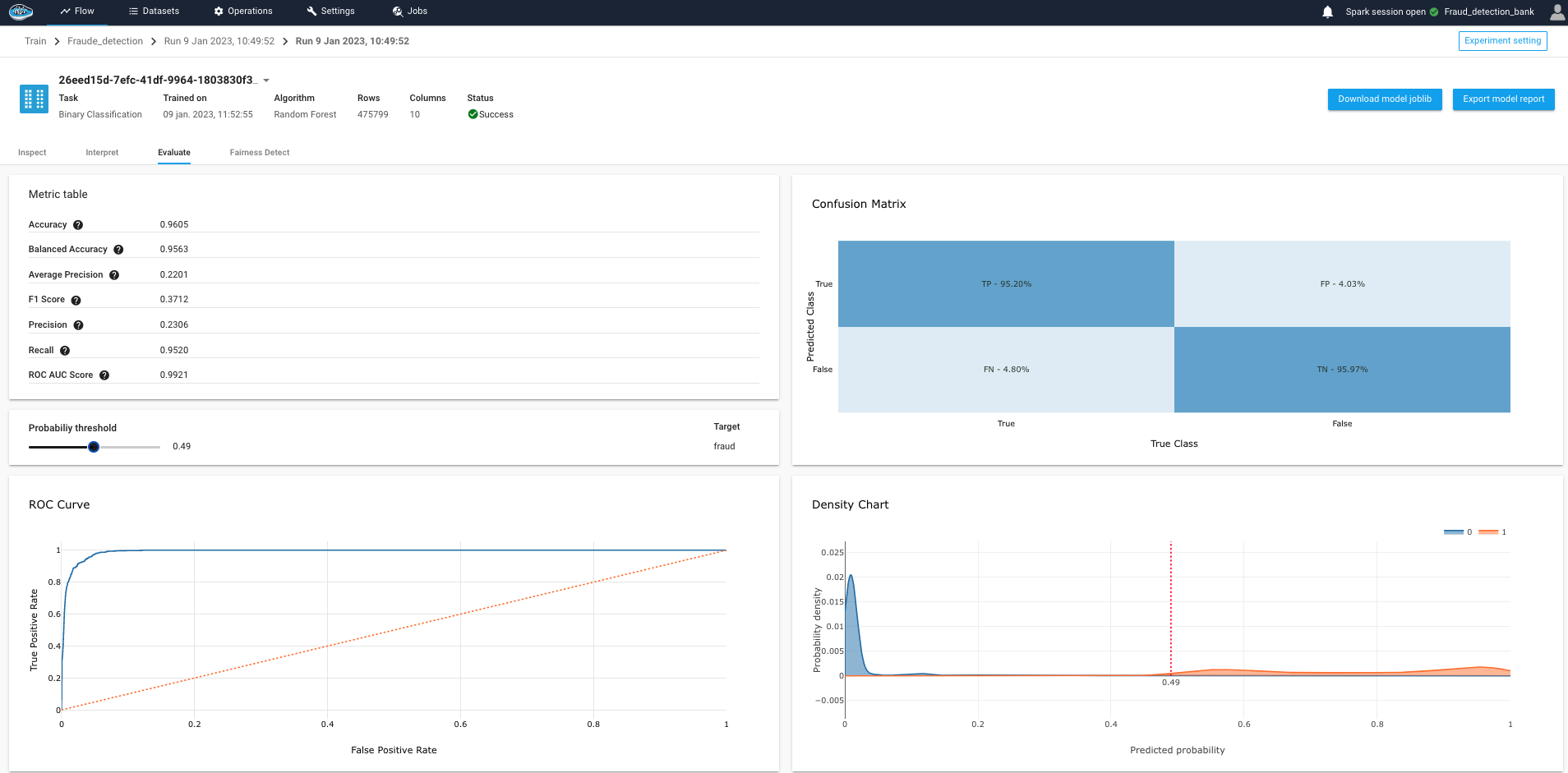

Claims Fraud detection

papAI employs NLP techniques to analyze unstructured data within claims documents, such as medical reports and incident descriptions. By understanding the narrative behind a claim.

The platform performs in-depth behavior analysis of customers, studying their transaction history, location patterns, and typical spending habits. It can recognize deviations from established customer behavior and raise alerts when it identifies actions that could indicate fraudulent activities.

o enhance fraud detection accuracy, papAI can seamlessly integrate with external data sources.This broader data pool provides a more comprehensive view of claimants and helps identify potential fraudulent activities.

Insurance underwriting

papAI enriches existing data with external sources, such as weather data, socioeconomic indicators, and healthcare statistics. By incorporating these additional data points, underwriters can gain a more comprehensive view of the risks associated with a policy, leading to more precise underwriting decisions.

papAI continuously adapts pricing models based on real-time data and emerging trends, ensuring that pricing remains competitive and reflective of current market conditions. This dynamic approach enables insurance companies to maintain profitable underwriting practices while providing attractive offers to policyholders.

papAI continuously monitors market conditions and competitor offerings. It can provide insights into how insurance companies’ underwriting strategy compares to industry standards and recommend adjustments to stay competitive and profitable.

Risk Assessment

The platform leverages machine learning models to predict future risks. Risk assessors can use these models to simulate different scenarios and assess potential risks, helping in proactive risk management.

papAI provides scenario analysis capabilities. Risk assessors can create and test various risk scenarios to understand the potential impact on the organization. This assists in preparing contingency plans and evaluating the consequences of different risk events.

papAI seamlessly integrates with external data sources, including financial market data, weather reports, and geopolitical events. This ensures that risk assessors have access to up-to-date and comprehensive information to make well-informed assessments.

Import relational databases (postgreSQL, mySQL, Oracle, MicrosoftSQL), upload CVS and Excel files, and insert APIs from a custom Python script.

The AI platform’s agile ETL will speed up massive data transfers to enhance your productivity outputs. The calculation engines are distributed without any configuration on your part.

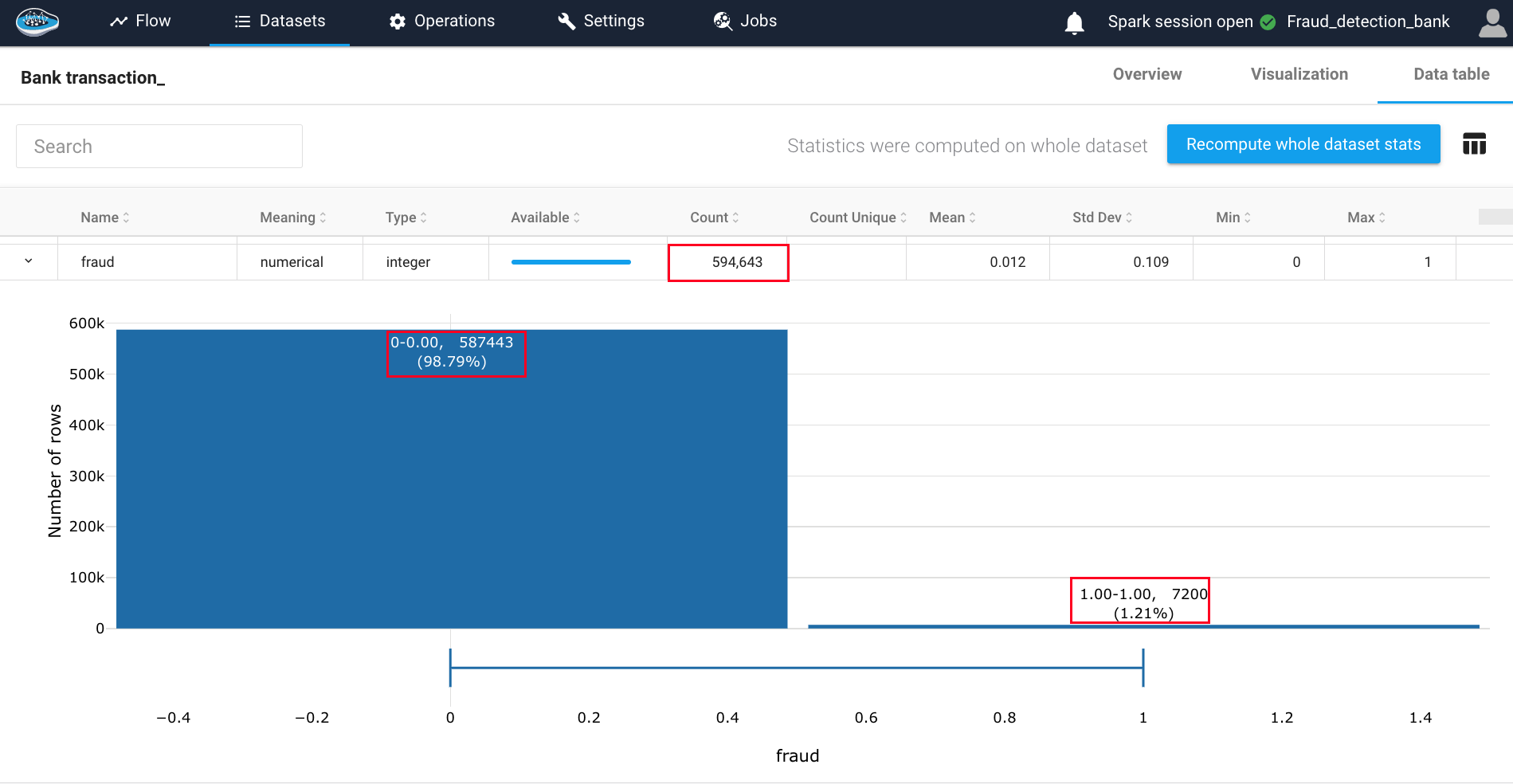

Create your own analyses and choose from the different vizualization models offered (Statistics, Histograms of numerical and categorical data…). You can also view 2D, 3D and geographical plots.

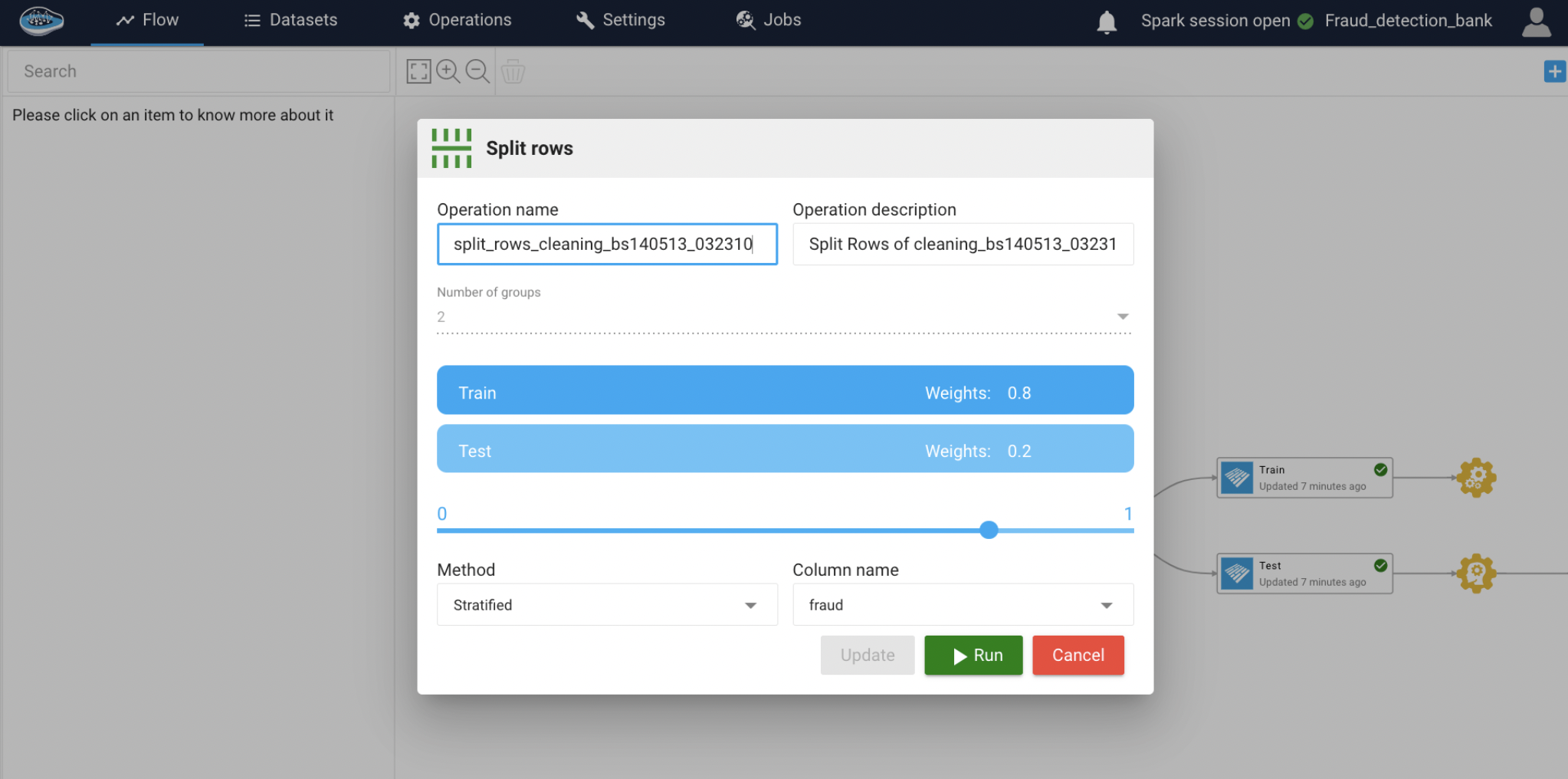

In papAI, powerful Machine Learning engineering will enable you to swiftly and easily deploy your predictive models throughout your pipelines: Feature Selection, Element Coding & Scaling, and Data Separation.

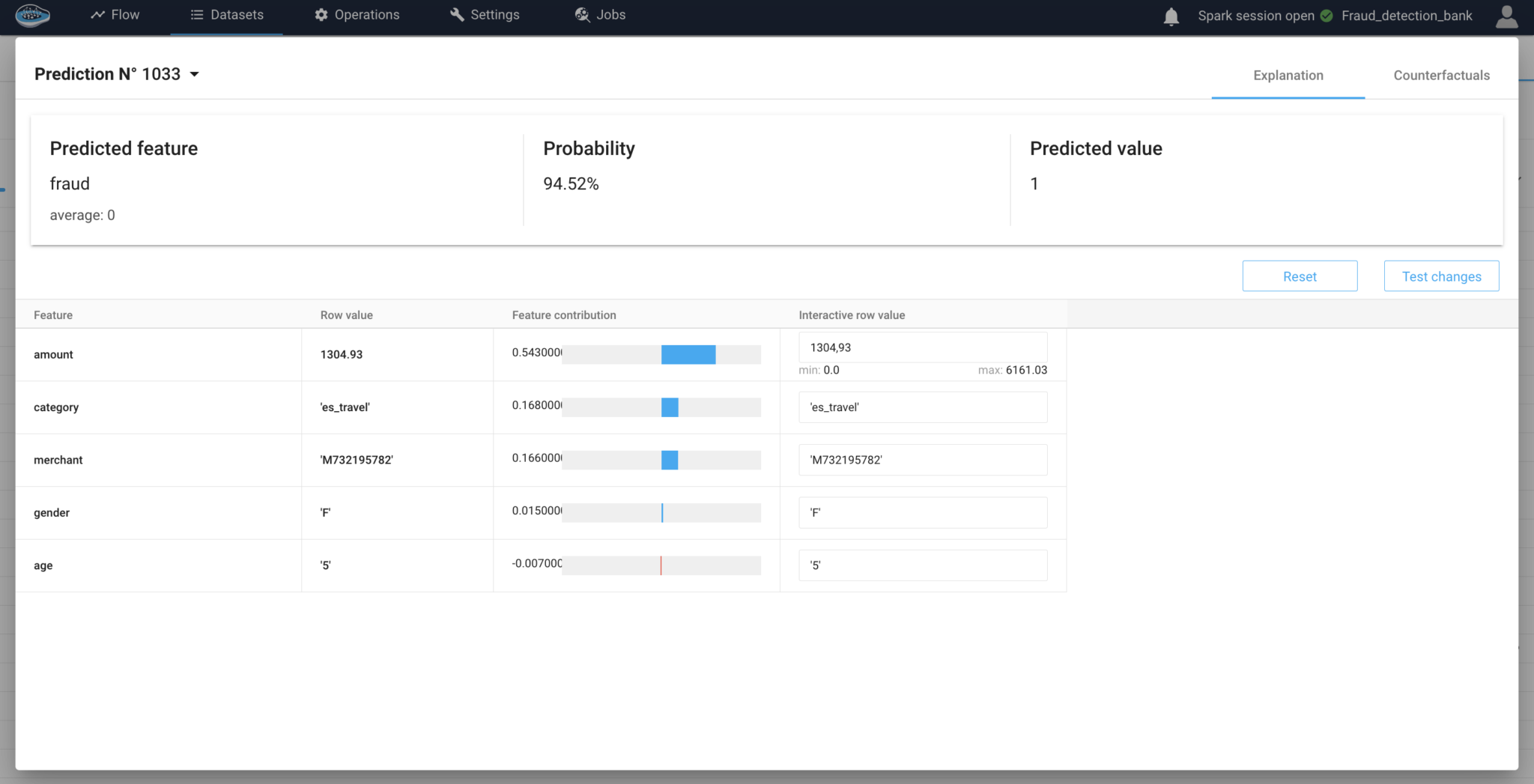

papAI offers a high degree of explicability of results thanks to its counter factual and feature impact functionality.

Accelerate from Data Collection to AI-Driven Decisions Swiftly

-

Real-time Data Processing

papAI can handle vast volumes of customer data in real-time, ensuring that insurance companies can make timely decisions based on the most up-to-date information.

-

Customizable AI Models

papAI allows insurance companies to tailor AI models to their specific needs. Whether it's churn prediction, or fraud detection, Insurance can create models that align with their unique business goals and requirements.

-

Explainable AI (XAI)

papAI provides transparent and interpretable AI models, allowing insurance companies to understand the reasoning behind AI-driven decisions. This feature is essential for compliance, regulatory reporting, and building trust with stakeholders.

-

Scalability

papAI is designed to scale with the evolving needs of insurance. Whether small or large, papAI can grow alongside the organization, ensuring that AI capabilities remain efficient and effective.

Step-by-Step AI Implementation: The Path to Enhanced Efficiency

How do we ensure our client's success?

Discover Our Use Cases

Explore our extensive range of use cases to see how papAI can address your specific needs and drive success in your organization.

Stay Ahead of Fraud - Sign Up for a Demo Today

AI-powered churn prediction systems have been shown to reduce churn costs by up to 80%.

Book your demo now to see papAI in action.