Transform Defense Logs & Rapport into Situational Awareness with AI...

Read MoreUnleashing the Power of Personalization: How Machine Learning (ML) is Transforming Customer Segmentation to Improve Marketing Strategy?

Table of Contents

ToggleMachine learning (ML) is one innovative technique that is redefining the field of consumer segmentation. Conventional advertising strategies are being replaced by dynamic and personalized techniques thanks to machine learning, which harnesses the power of cutting-edge algorithms and data analysis. In research by Evergage, 88% of marketers said that customization backed by machine learning algorithms had significantly improved their marketing efforts.

In this article, we’ll delve into the fascinating world of machine learning and see how it has a big influence on consumer segmentation. resulting in improved client engagement, retention, and ultimately, business achievement.

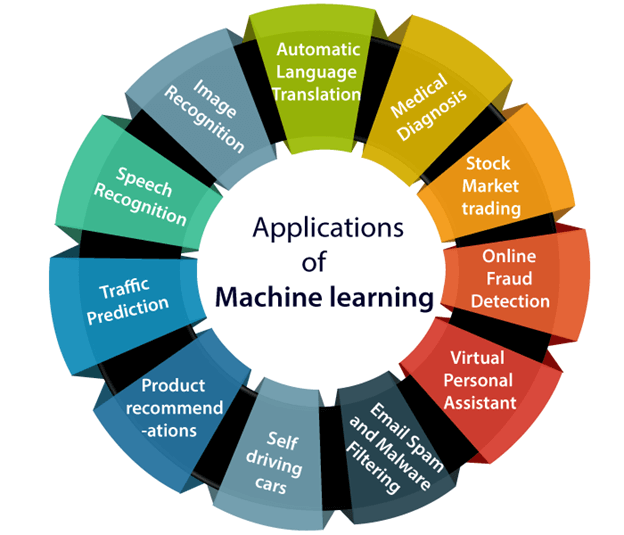

What do we Mean by Machine Learning?

A subfield of artificial intelligence (AI) and computer science called machine learning focuses on using data and algorithms to reproduce how people learn, progressively increasing the accuracy of the system.

The rapidly expanding discipline of data science includes machine learning as a key element. Algorithms are taught using statistical techniques to produce classifications or predictions and to find important insights in data mining projects. The decisions made as a result of these insights influence key growth indicators in applications and enterprises, ideally. Data scientists will be more in demand as big data continues to develop and flourish. They will be expected to assist in determining the most pertinent business issues and the information needed to address them.

The Importance of Customer Segmentation

Customer segmentation is essential to every company’ success. It entails classifying the target market into several categories according to traits, habits, or interests that they share. Businesses may customise their marketing tactics and offers to efficiently engage and convert their target audience by knowing the varying demands and motivations of various client segments. Customer segmentation is important for the following reasons:

1- Targeted Marketing: By dividing their consumer base into distinct categories, companies may concentrate their resources and efforts on those clients who are most likely to be interested in their goods or services. Businesses can design personalized marketing strategies that engage with their audience and increase conversion rates and return on investment by knowing the particular requirements and preferences of each group.

2- Personalized Communication: Today’s consumers demand individualized service. Businesses may target distinct sectors of their customer base with pertinent and personalized communications that speak to their unique needs, wants, and interests. Businesses may build stronger relationships with clients, increase brand loyalty, and create lasting connections by customizing their communication.

3- More Effective Customer Retention: Businesses may identify their most important client segments and dedicate resources to fortify ties with these groups by segmenting their customer base. Businesses may increase client retention rates by giving them individualized experiences and continually addressing their changing demands. More brand advocates and referrals from satisfied and devoted clients will lead to further expansion of the company.

Traditional Customer Segmentation's Drawbacks

Traditional customer segmentation techniques have been utilized extensively in the past, but they have a number of drawbacks that restrict their usefulness in the fast-paced corporate world of today. The following are some significant drawbacks of conventional consumer segmentation:

1- More Segmentation Criteria

Basic demographic data like age, gender, or geography are frequently used in traditional client segmentation. The nuance and complexities of client behavior are not sufficiently captured by these parameters, despite the fact that they do offer some insights. Various aspects, like as online interactions, social media presence, and digital touchpoints, have an impact on customers nowadays. Weak knowledge of consumer behavior and preferences may result from an exclusive focus on demographic information.

2- Absence of Timely Information

Traditional consumer segmentation frequently uses static information gathered at particular moments in time. But consumer preferences and habits are always changing. Businesses risk missing out on important data that might inspire successful marketing initiatives if they don’t have real-time insights. The capacity to quickly adjust and react to developing trends may be constrained by the fact that traditional segmentation may not reflect current changes in customer behavior.

3- Uncertainty Regarding Future Behaviour

Traditional customer segmentation places a strong emphasis on historical data, which offers insights into previous behavior and preferences. Although previous data is useful, it may not be able to forecast client behavior in the future. Relying entirely on previous performance may restrict the capacity to predict and address changing client demands because market dynamics and customer preferences are both dynamic. Future trend identification is a proactive task for businesses, and standard categorization could not offer the required foresight.

Future Customer Segmentation: Opportunities and Trends

1- Micro-Segmentation

A study conducted by Deloitte found that companies implementing micro-segmentation strategies experienced an average increase in sales of 19% and a decrease in marketing costs of 15%. Customers are often divided into broad groups as part of traditional customer segmentation. However, micro-segmentation, which divides customers into far more narrowly focused categories, is where customer segmentation is headed in the future. Businesses may offer highly personalized experiences and services by using micro-segmentation to learn the specific tastes and behaviors of each individual consumer.

2- Segmenting using Several Channels

Customers connect with companies through a variety of touchpoints, including websites, social media, mobile applications, and physical storefronts, in today’s omnichannel environment. In cross-channel segmentation, consumer information from these many channels is combined to provide a single customer perspective. This makes it possible for organisations to provide unified, seamless experiences across many channels, increasing consumer happiness and loyalty.

3- Forecasting Segmentation

According to a study by Forrester, companies that effectively utilize predictive segmentation experience a 35% increase in customer engagement rates and a 25% increase in marketing-generated revenue. In order to predict future client preferences and behaviors, predictive segmentation makes use of machine learning techniques. The algorithms can analyze past consumer data to find patterns and trends that may be used by firms to forecast future customer behavior. This foresight enables businesses to proactively modify their marketing tactics and services to match client requirements before they express them, improving customer happiness and increasing conversion rates.

AI and Machine Learning for Sales: The Key to Unlocking Growth Potential

The development of artificial intelligence (AI) has significantly changed the sales industry, which has witnessed a remarkable evolution throughout time. The way companies approach sales processes and strategies has been completely transformed by AI. In this white paper, we will examine the concept of AI in sales, its historical evolution, and the advantages it provides for companies.

Case Studies: How the papAI solution helps you achieve success in personalized marketing

A Customer Relationship Management (CRM) system is a powerful tool that enables businesses and organizations to effectively handle and understand their customer interactions.

Initially tailored for large corporations, the advent of the Internet has extended the accessibility of CRM systems to small business owners. These tools facilitate the collection and organization of customer data within a centralized CRM database, unlocking the potential for sophisticated analysis techniques such as customer segmentation and comprehensive contact history.

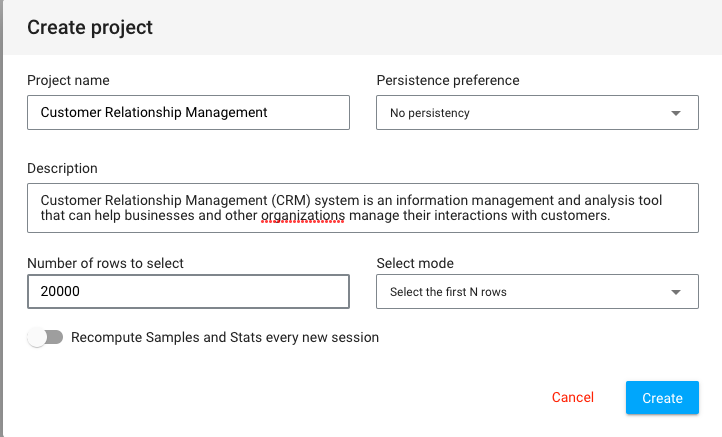

Create Project

When you log in to papAI Solution, you will be directed to your project homepage, where you can see all your created projects and collaborations. To begin a new project, simply click on the Create Project button. This action will open a pop-up window with various settings that need to be filled out. These settings include the project name, a brief description, and persistency options, you can also specify the number of samples to be displayed and choose the order selection, such as displaying the first or last N rows or randomizing the order. Once you have completed filling in the necessary settings, you can finalize the process by clicking on the Create button.

After clicking Create, your newly created project will automatically be added to your main page. You can now start working on it right away. With papAI, starting a new project has never been simpler!

Import dataset

Thanks to the variety of data sources available, you have the flexibility to import data from virtually anywhere into your papAI project for analysis and visualization. Whether it’s from your local machine, an external database (SQL or NoSQL), cloud storage, or an API, papAI makes it easy to bring in data for analysis. Additionally, you can even create a completely new dataset using the specialized Python or SQL recipe editor.

To get started with importing your data, you can use the tools provided in the papAI interface. For our specific use case, we’ll be importing our dataset from our local machine using the appropriate tool. You can access this tool by clicking the plus button located in the top right corner of the interface or by using the Import dataset button in the Flow interface.

Once you’ve selected the local import option, a new interface will appear that allows you to easily import any tabular file in CSV or XLSX format. You can import your desired files either by clicking the Import button or by using the drag-and-drop feature. Once your data has been imported, you can preview a subset of the data to verify that it was imported correctly. After ensuring that everything is in order, you can simply select the Import button to start the uploading process. A progress bar will keep you informed of the status of the upload, and when it’s complete, your dataset will be ready for use in your project’s flow.

Cohort Analysis

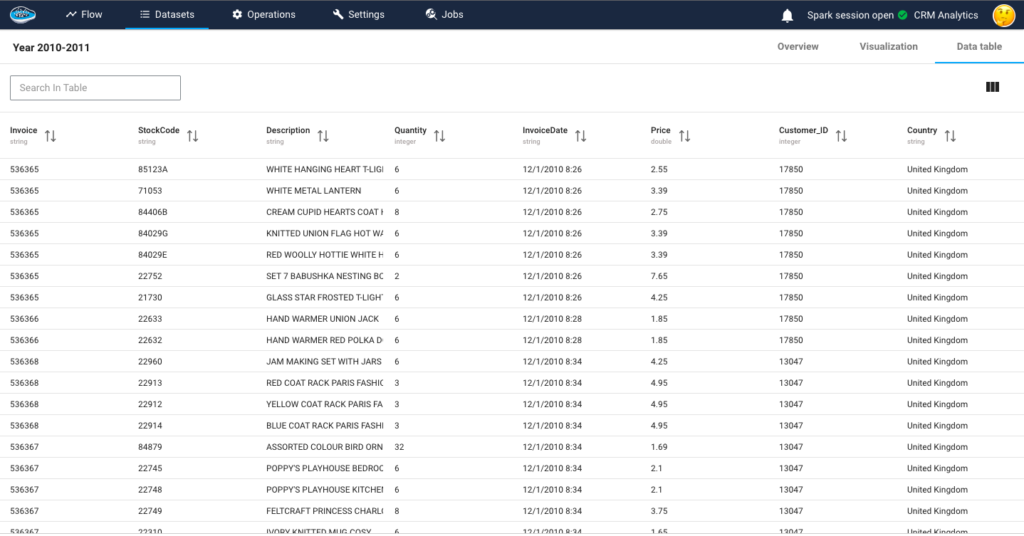

Once you’ve imported your dataset into papAI, you can begin exploring its content and obtaining an initial analysis to determine the cleaning steps necessary to extract the most valuable insights from your data. Cohort analysis involves segregating data within a dataset into comparable groups for analysis. These groups, known as cohorts, typically share similar qualities or experiences over a specific period.

The dataset consists of several variables that provide detailed information about each transaction. The InvoiceNo variable represents a unique identifier for each transaction, distinguishing invoices from aborted operations indicated by the prefix C. The StockCode variable corresponds to a specific product code, uniquely identifying each item in the company’s product catalog. The Description variable contains the name or description of the product. The Quantity variable indicates the number of products sold for each invoice, reflecting the quantity purchased. The InvoiceDate variable records the date and time of each invoice. The UnitPrice variable denotes the price of each product in British Pounds (GBP). The CustomerID variable represents a unique customer identification number. Lastly, the Country variable specifies the country where the respective customer resides. These variables collectively provide comprehensive details about the transactions, products, customers, and their locations.

In our tutorial we will need to add a new column total price that indicates the quantity multiplied by the unit price and to do so, our platform offers some basic operation as you can see in the following video.

Examining a customer’s or user’s behavior throughout their lifecycle can unveil significant trends. By dividing customers into smaller groups, patterns throughout each individual’s journey can be observed more effectively. This approach contrasts with analyzing all clients uniformly, disregarding the natural cycle that a client undergoes.

For example, we can divide the customers based on the country where they reside.

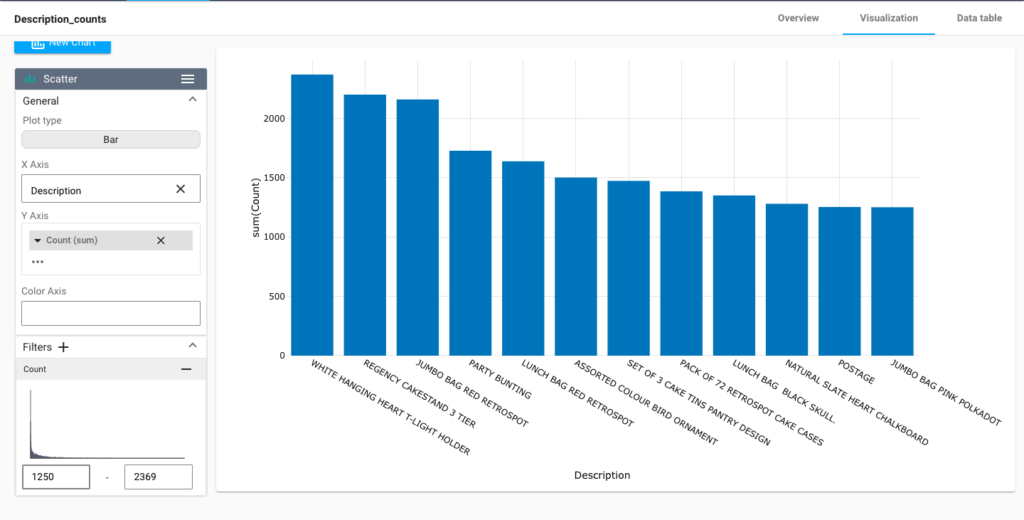

We can also divide the customers based on the product description and filter them by descending order of bought products.

By visualizing the data, we can gain insights into the underlying patterns and trends that might not be immediately apparent from just looking at the raw data. This can help us to identify potential issues or opportunities to improve the quality of our data.

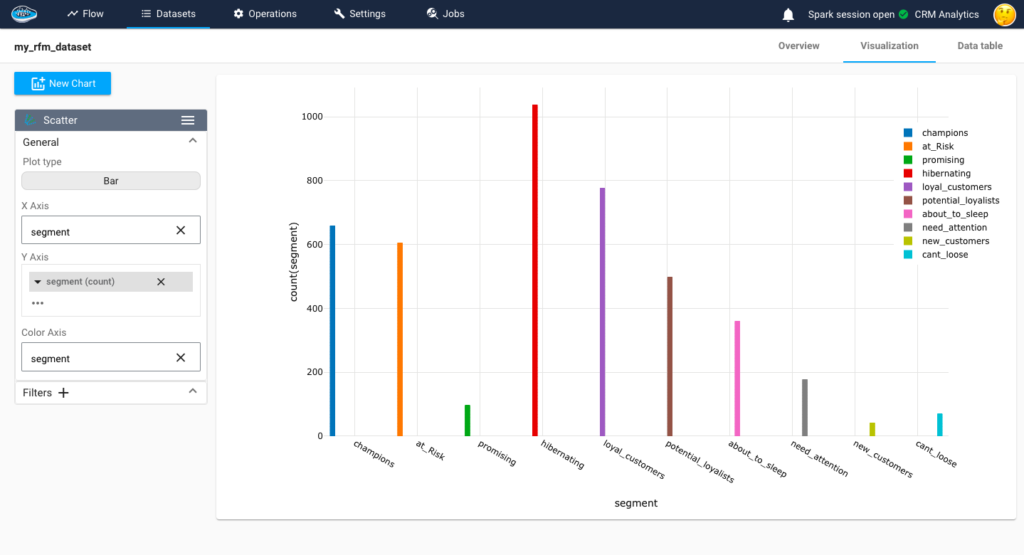

Customer Segmentation With RFM

Customer segmentation with RFM (Recency, Frequency, Monetary) analysis is a powerful technique used to categorize customers based on their transactional behavior. RFM analysis considers three key factors: recency, which measures how recently a customer made a purchase; frequency, which measures how often a customer makes purchases; and monetary, which measures the total monetary value of a customer’s purchases. By analyzing these three dimensions, customers can be segmented into distinct groups that share similar characteristics and behaviors.

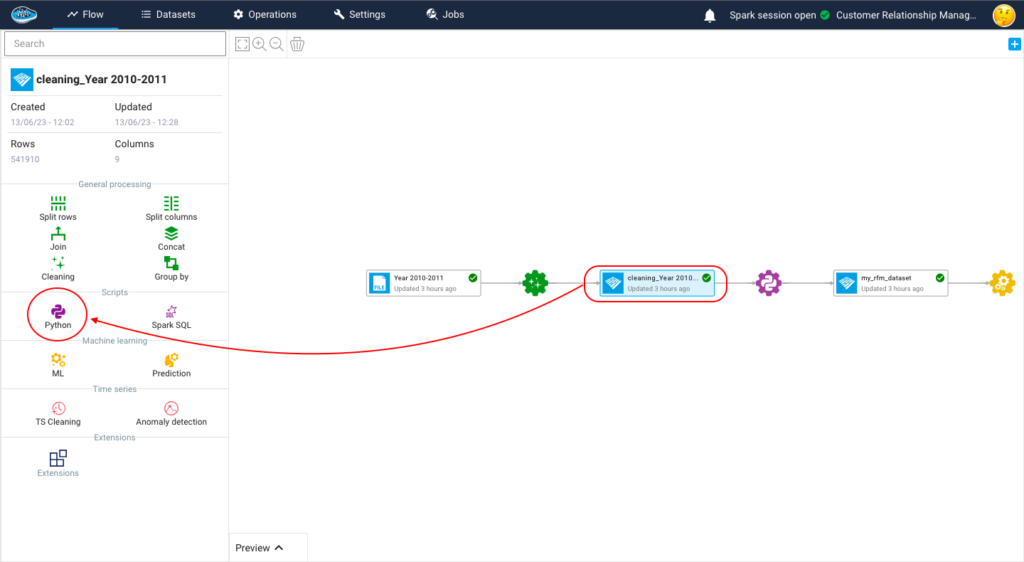

To calculate the RFM score we have to create a Python recipe, to do so just click on the dataset you want to calculate the RFM on then in the left menu you click on Python, and a new script will be created in which you fill in your script.

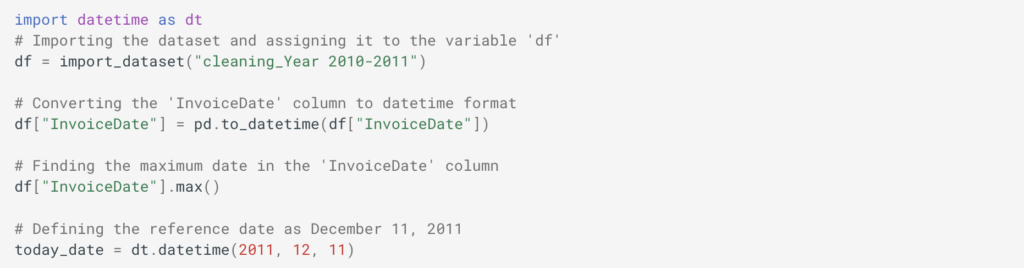

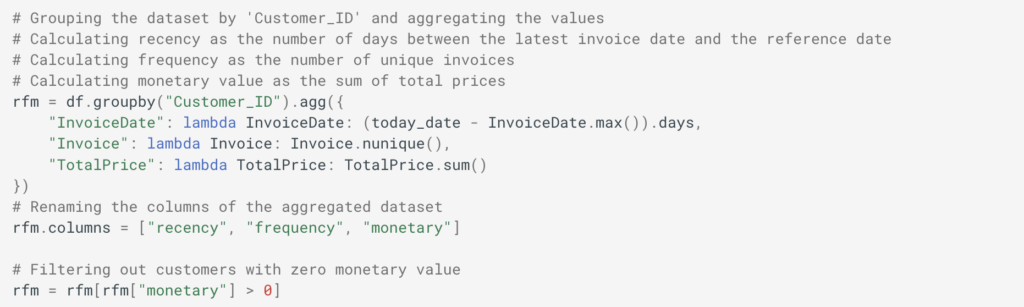

The code begins by importing a dataset. This dataset likely contains information about customer transactions, including the customer ID, invoice date, invoice details, and total price. The InvoiceDate column is then converted to DateTime format to enable further calculations based on dates. The maximum date in the InvoiceDate column is also determined.

RFM values are calculated for each customer by grouping the dataset based on the Customer_ID column and performing aggregations. The following RFM metrics are calculated:

Recency: It represents the number of days between the latest invoice date and a reference date (December 11, 2011 in this case).

Frequency: It represents the number of unique invoices for each customer.

Monetary: It represents the sum of total prices for each customer. To ensure meaningful segmentation, customers with zero monetary value (i.e., no purchases) are filtered out.

To ensure meaningful segmentation, customers with zero monetary value (i.e., no purchases) are filtered out.

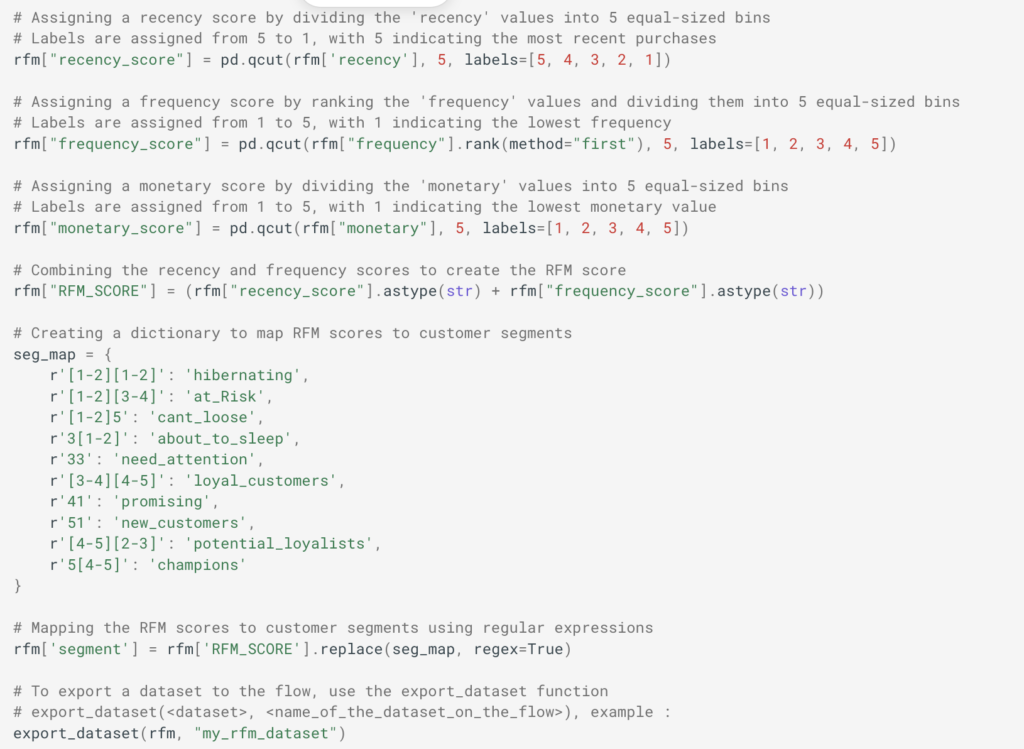

RFM scores are assigned to each customer based on their recency, frequency, and monetary values. The scores are divided into quintiles (5 bins) to create a relative ranking. The highest score indicates the best value for a particular RFM metric. The following steps are performed for scoring:

Recency Score: The recency values are divided into 5 equal-sized bins, and labels from 5 to 1 are assigned, with 5 being the most recent purchases.

Frequency Score: The frequency values are ranked and divided into 5 equal-sized bins, and labels from 1 to 5 are assigned, with 1 indicating the lowest frequency.

Monetary Score: The monetary values are divided into 5 equal-sized bins, and labels from 1 to 5 are assigned, with 1 indicating the lowest monetary value.

The RFM scores for each customer are combined to create an overall RFM score. For example, if a customer has a recency score of 4 and a frequency score of 3, their RFM score will be ’43’.

Recency score reflects the idea that customers who have made more recent purchases are likely to be more engaged and responsive to marketing efforts. Frequency score highlights the loyalty and engagement level of a customer, as frequent purchasers often represent the most valuable customers. Monetary score value provides insights into the spending power and profitability of a customer, as customers who have spent more are typically more valuable to the business.

Clustering

At this stage, your dataset is set be used for training and testing some models and choose the right one in the end to be deployed in production. we can launch the ML process by pressing the training dataset and then the ML Lab icon. It will give you access to the ML Lab where you will be testing different models. But first you will need to define the use case you want to tackle. Creating a ML use case is very simple since you need to click on the New use case button. Through a pop-up, you can choose the type of the use case required to answer it, for our case, it’s a Clustering problem.

When accessing your use case, you are able to create and build your own ML pipeline easily through the ML Lab. The ML Lab gives you the ability to create a pipeline from scratch with multiple models and parameters to optimize the process and extract the best model without any code. To begin the process, you need to select Create Prototypes and a new interface will appear with the first step which is the feature selection. Through this step, you select the features to be taken into account in the model training and also apply some preprocessing to ensure better results. Following the feature selection comes the model selection where we are going to simply select the regular ML models such as Mean Shift or K-Means with their default parameters To add them, simply toggle the button next to the model to activate it.

Model evaluation

In the papAI AutoML module, we have several metrics to evaluate our models. The Davies-Bouldin Index measures the quality of clustering by computing the average similarity between each cluster and its most similar cluster while considering the average dissimilarity between each cluster and the least similar cluster. The index ranges from 0 to infinity, where a lower value indicates better clustering. A value closer to 0 indicates tight and well-separated clusters. The Silhouette Coefficient assesses the quality of clustering by evaluating how well each data point fits within its assigned cluster compared to other clusters. It computes the average silhouette coefficient for all data points, ranging from -1 to 1. A coefficient close to 1 indicates that the data point is well-matched to its own cluster and poorly matched to neighboring clusters, indicating good clustering. Negative values indicate that data points might be assigned to the wrong clusters. The Calinski-Harabasz Index, also known as the Variance Ratio Criterion, is a measure of cluster separation and compactness. It calculates the ratio of between-cluster dispersion to within-cluster dispersion. A higher index value indicates better-defined and more separated clusters. It is often used to determine the optimal number of clusters by comparing index values across different cluster solutions. In our case, we focus mainly on the Silhouette Coefficient.

Interested in discovering papAI?

Our commercial team is at your disposal for any questions

Why AIOps Is Key to Cyber Threat Detection in Defense?

Why AIOps Is Key to Cyber Threat Detection in Defense?...

Read MoreHow AI Transforms Predictive Maintenance in Defense Equipment

How AI Transforms Predictive Maintenance in Defense Equipment In a...

Read MoreHow to Scale AI Without Breaking Your Infrastructure in 2025

How to Scale AI Without Breaking Your Infrastructure in 2025...

Read More