Why Should You Consolidate Your AI Tools for Faster Scaling?...

Read MoreUse AI to Predict Your Customer's Future Value

Table of Contents

ToggleUnderstanding and fostering your relationships with customers is now essential for long-term success in today’s fiercely competitive market. A crucial indicator, customer lifetime value (CLV) provides a forward-looking view of the total revenue a company can anticipate from a client over the course of their relationship.

However, the dynamic nature of client behavior makes it difficult for traditional CLV estimates, which are frequently based on past data, to stay up. Artificial Intelligence (AI) has the potential to revolutionize how businesses not only forecast but also actively maximize CLV, resulting in more focused strategies and substantial profits.

Companies implementing AI-powered personalization have reported a 40% increase in average order value when compared to generic content approaches (Adobe Digital Insights, 2023, as cited by Number Analytics).

Find out how papAI can improve the deployment of AI projects in Sales Teams.

Explore our article to learn about the approaches, advantages, and doable actions for using AI into your CLV plan and gaining unmatched insights on your clientele.

How does Customer Life-time Value Become a Priority?

In the past, companies frequently concentrated on one-off deals. The query was, “How much did this customer buy today?” It had very little foresight. In the 1970s and 1980s, the notion that a customer’s actual worth encompasses not just a single transaction but also their whole connection with your brand began to acquire significant momentum, especially in the direct marketing industry.

Consider this: late-night TV marketers and mail-order catalogues were spending a lot of money to reach individuals. They soon discovered that not every customer was created equal. While some would make a single purchase and then disappear, others would return and even promote the brand. As a result, early techniques for monitoring and forecasting consumer behavior were created, frequently utilising what is known as RFM analysis, Recency, Frequency, and Monetary Value. In essence, how much do they spend, how frequently do they buy, and how recently did they buy? In order to effectively target their efforts, these direct marketers were essentially attempting to identify who their most important clients were.

Businesses now have the means to gather and handle enormous volumes of consumer data thanks to the development of consumer Relationship Management (CRM) systems in the 2000s and beyond. As a result, CLV became a useful statistic that could be computed and utilized rather than merely a theoretical idea.

More intricate elements like customer involvement, loyalty, retention rates, and even the likelihood that a customer will recommend others were included, going beyond straightforward calculations. Businesses now have the means to gather and handle enormous volumes of consumer data, particularly with the advent of consumer Relationship Management (CRM) systems in the 2000s and later. As a result, CLV became more than just a theoretical idea.

Why Customer Lifetime Value is the Key to Profit

1- It helps prioritize marketing and acquisition efforts:

Marketing and sales teams can take precise action when they are aware of a customer’s potential value. You might focus your approach on projected CLV rather than wide demographics. You can focus more on those channels, for example, if your data indicates that subscribers from a particular area or campaign typically generate higher revenue over time. Similarly, it is simpler to defend higher acquisition prices for clients who are more likely to remain loyal and increase their spending. This focused strategy lowers wasteful spending on low-value leads while simultaneously increasing return on investment. It’s similar to laser-focusing your go-to-market strategy.

2- It supports smarter product and service personalization

Knowing who your high-value clients are can help you create experiences that will keep them coming back. Using behavior, preferences, and previous purchases to create offerings that truly matter to customers is what this goes beyond generic personalisation. CLV data aids in the creation of interactions that strengthen both financial and emotional loyalty, such as individualised packages, expedited support, or exclusive access. This type of relevancy eventually results in increased client retention, more regular purchases, and even referrals from satisfied customers. The more value you add, the more value you take out. It’s a positive feedback loop.

3- It fuels financial forecasting and strategic planning

CLV is a strong forecasting tool from a business standpoint. It assists leadership and finance teams in better planning customer support resources, modelling revenue, and predicting the effects of changes in price, acquisition, or churn on the bottom line. You can forecast how much growth your present client base can sustain and where you need to add to it by using a trustworthy CLV model. Internal budget defence, margin optimisation, and operational scalability all depend on that degree of information. To put it briefly, CLV is a strategic lens for growth rather than merely a measure.

What is the difference between Traditional vs AI-Enhanced CLV Calculation?

Traditional and AI-enhanced CLV (Customer Lifetime Value) calculations differ primarily in how they interpret and forecast consumer behavior. Typical formulas used by traditional models include average purchase value, frequency of purchases, and expected client lifespan. Although this method is straightforward and easy to use, it has a tendency to average out individual customer experiences, providing a static perspective that ignores changes over time. The assumption that every consumer follows a similar pattern might result in erroneous forecasts, particularly in industries or marketplaces that are subject to complicated buyer behavior or rapid change.

However, AI-enhanced CLV continuously learns from new behavior and finds patterns in historical data using machine learning models. Hundreds of variables, including product preferences, engagement signals, customer service contacts, the timing and value of previous transactions, and even outside variables like seasonality, can be considered by these models. AI models generate dynamic forecasts that alter over time rather than giving each customer a set value, which helps organisations better predict attrition, upsell opportunities, and value shifts.

Segmentation and personalisation are two further significant benefits of AI-enhanced CLV. Conventional models may classify clients into simple groups, such as “new,” “active,” or “at-risk.” AI is capable of much more, including grouping clients according to subtle behavioral characteristics and forecasting how their value will fluctuate based on the touchpoints they experience. AI, for instance, can recognise a customer who hasn’t made a purchase in months but is still quite active on email, indicating that they would be valuable in the future. This individual can be classified as inactive by traditional models, completely missing the chance.

What is The Role of AI and Machine Learning in CLV?

1- Machine Learning Models: Regression, Decision Trees, Ensembles

Modern CLV estimate relies heavily on machine learning since it may identify patterns that previous approaches frequently miss. One of the most popular places to start is with regression models, especially logistic and linear regression. They provide a comparatively easy method of connecting client attributes such as average expenditure, tenure, and frequency of visits to anticipated income. These models are simple to use and interpret, but they may not be able to handle complex customer behaviors or nonlinear interactions.

Decision tree-based models can help with that. Decision trees, as opposed to regressions, use the characteristics to build decision rules that deconstruct the data. They are therefore much more adept at simulating how variables interact. For instance, they can determine that clients who participate in email marketing and make frequent purchases are more valuable, but only if they have been active for longer than three months. Predictions are given greater nuance by these rule-based splits, which are particularly useful in marketing scenarios with diverse, complicated datasets.

2- Deep Learning Approaches: RNNs, Zero-Inflated Lognormal Models

By identifying complex, sequential patterns in customer behavior, deep learning elevates CLV modelling to a new level. Particularly useful are Recurrent Neural Networks (RNNs), which handle data in a time-sensitive manner. When simulating the evolution of a customer’s behaviors over time, such as site visits or purchases, this is helpful. RNNs are perfect for forecasting the next action or purchase amount because they take into account the sequence of occurrences rather than analysing each data point separately.

The application of probabilistic models, such as the zero-inflated lognormal model, is one innovative strategy that is gaining popularity. Two facts about consumer behavior are taken into consideration by this model: many customers never make another purchase after their initial one, and among those who do, spending habits differ greatly. The lognormal distribution models the long-tail spenders, whereas the “zero-inflated” portion deals with the drop-offs. This dual strategy more accurately captures the dynamics of actual customers, particularly in sectors with high churn and low repeat rates.

How to Implement AI to CLV Prediction?

1. Gathering and preparing data:

Let’s start by collecting all the information required to estimate Customer Lifetime Value (CLV). We’re discussing anything and everything, including past purchases, website clicks, and social media interactions. Getting as much information as you can from a variety of sources, such as CRM systems, e-commerce sites, and even customer reviews, is crucial in this situation. After obtaining all of this data, we must tidy it and put it in a proper order. This entails removing any duplicates, correcting any mistakes, and ensuring that everything is in a format that our AI models can comprehend.

2. Selecting the Appropriate AI Model:

Now that we have flawless data, it’s time to select the appropriate AI model to utilise. Numerous AI algorithms are available, each with unique advantages and disadvantages. Taking into account our unique dataset and business objectives, we must select the model that is most appropriate for predicting CLV. There may be some trial and error involved here, but that’s all the fun! The objective is to identify which machine learning algorithm, a more complex deep learning model or a machine learning algorithm like linear regression, produces the most accurate predictions.

3. Training and Testing the Model:

The next step is to test our AI model after we’ve selected it. This process, known as training the model, will begin with us giving it a portion of our data to work with. It’s similar to teaching a dog new tricks in that it becomes more adept at predicting CLV the more data it is given. However, we must ensure that it is performing its duties effectively; we cannot simply rely on its word. Testing is then relevant. To see how well the model predicts CLV, we will feed it some fresh, unseen data.

AI models play a transformative role in unlocking customer insights, enabling businesses to predict future value with precision.At Datategy, we don’t rely on black-box models. We focus on explainable AI that empowers businesses to understand, trust, and act confidently on their data-driven insights.

Thibaud Ishacian

Head of Product - Datategy

Real-world Applications of Using AI to Predict CLV

Retail Customer Segmentation: Using AI, retailers can divide up their clientele into groups according to potential CLV. In order to maximize long-term profitability, they can identify segments with the highest customer lifetime value (CLV) and customize marketing strategies by analyzing past purchasing behavior, demographics, and engagement patterns.

Customer Lifetime Value Prediction in Telecommunications: Telecommunications companies use AI to forecast their customers’ CLV. Through the examination of usage trends, past customer interactions, and service records, they are able to pinpoint high-value clients and apply focused retention tactics to minimize attrition and optimize client lifetime value.

Cross-selling in the financial services industry: Banks and other financial organizations use AI to forecast customer lifetime values (CLVs) and spot chances to cross-sell extra goods and services. They can target high CLV customers with tailored offers by examining transaction history, financial behavior, and customer demographics. This will increase.

Player Retention in Online Gaming: AI is used by online gaming companies to predict players’ CLV and maximize player retention. They can detect high CLV players and customize gameplay and promotions to boost retention and optimize lifetime value by examining gaming behavior, in-game purchases, and engagement patterns.

Subscription services for digital media: AI is used by digital media platforms to forecast subscribers’ lifetime values and maximize subscription retention. Through the examination of viewing patterns, preferred content, and engagement metrics, they are able to pinpoint high CLV subscribers and customize subscription offers and content suggestions to boost retention and optimize earnings.

AI and Machine Learning for Sales:

The Key to Unlocking Growth Potential

The development of artificial intelligence (AI) has significantly changed the sales industry, which has witnessed a remarkable evolution throughout time. The way companies approach sales processes and strategies has been completely transformed by AI. In this white paper, we will examine the concept of AI in sales, its historical evolution, and the advantages it provides for companies.

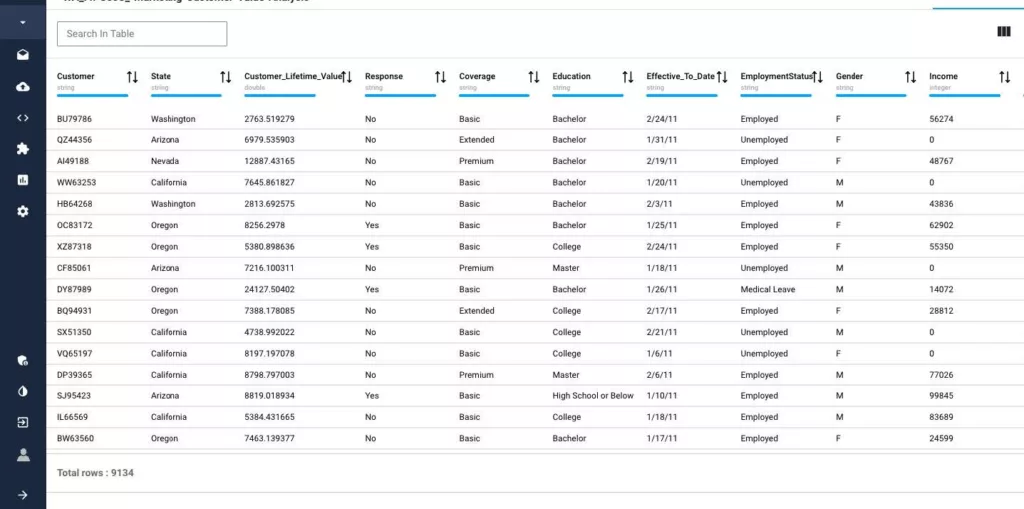

Use Case: Use Case: Using papAI Solution to predict Customer Life-time Value

Context

This dataset provides a comprehensive view of the factors influencing CLV, it contains detailed information about customers and their interactions with an insurance company, such as Customer ID, State, Gender, Income, and Marital Status; insurance-specific data such as Coverage, Education, Employment Status, Policy Type, Policy, Renew Offer Type, Sales Channel, Total Claim Amount, Vehicle Class, and Vehicle Size; and time-related factors like Effective Date, Months Since Last Claim, Months Since Policy Inception, and Number of Open Complaints. The Customer Lifetime Value is the target variable, while Response indicates whether a customer responded to marketing efforts.

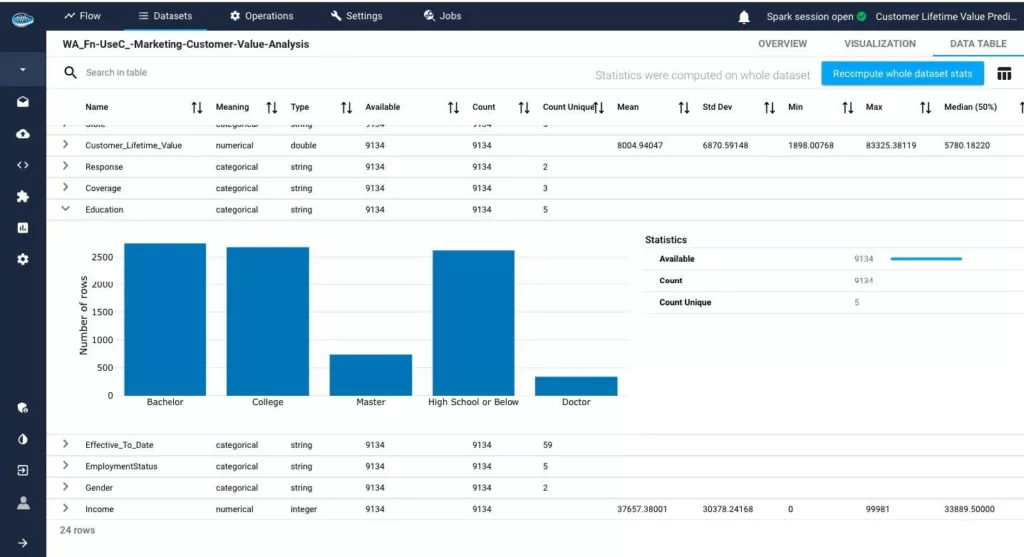

1- Data Exploration

papAI further enhances its functionality with an automated statistics calculation feature, offering users an in-depth understanding of dataset characteristics through detailed statistical analysis.

This feature automatically computes various statistics for each variable within the dataset. Key statistics calculated include the type of each variable, which can be either “categorical” or “numerical”.

The system computes average value, standard deviation (a measure of data dispersion), minimum value, maximum value, and other relevant metrics for numerical variables.

For categorical variables, the feature identifies the distinct categories and their respective frequencies, offering insights into the distribution of categorical data. This robust analysis equips users with a thorough understanding of their data, facilitating more informed decision-making and analysis.

The provided dataset has lots of details, we can cite :

– There are 9134 Observations of 24 Variable

– There is a mix of categorical and continuous DataType.

– There are no null values, so no further action is required to replace

missing or null values.

– Mean of CLV is 8004.94047 and the median is 5780.18220 .

– There are a lot of Customers with low CLV. Very few customers

with high CLV.

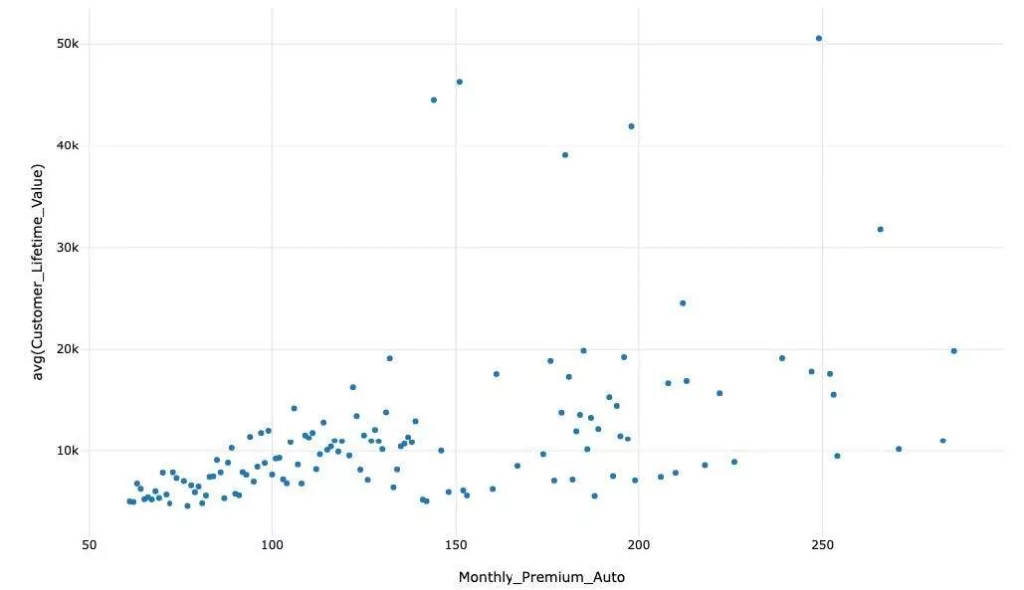

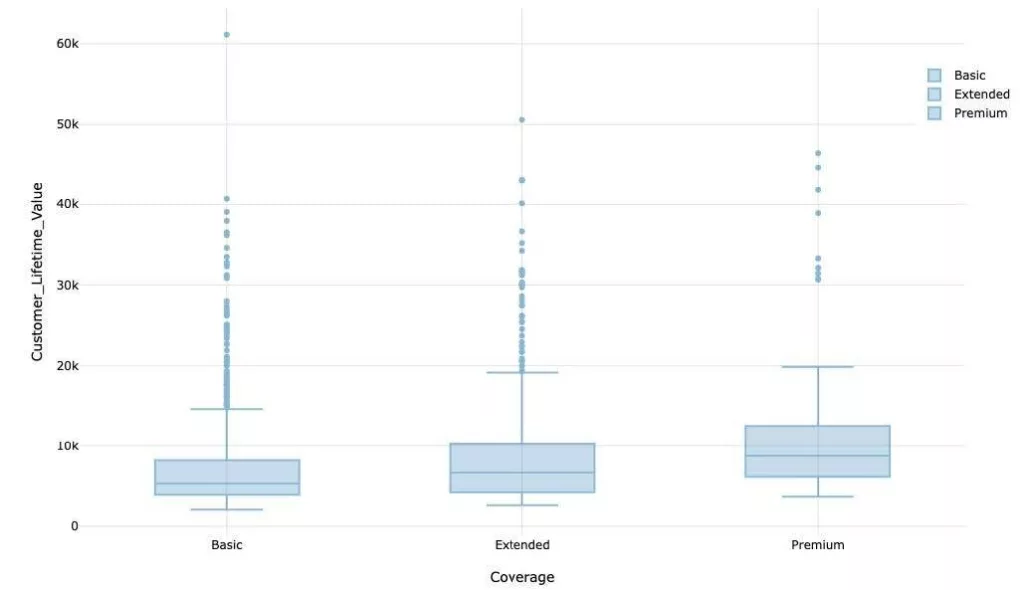

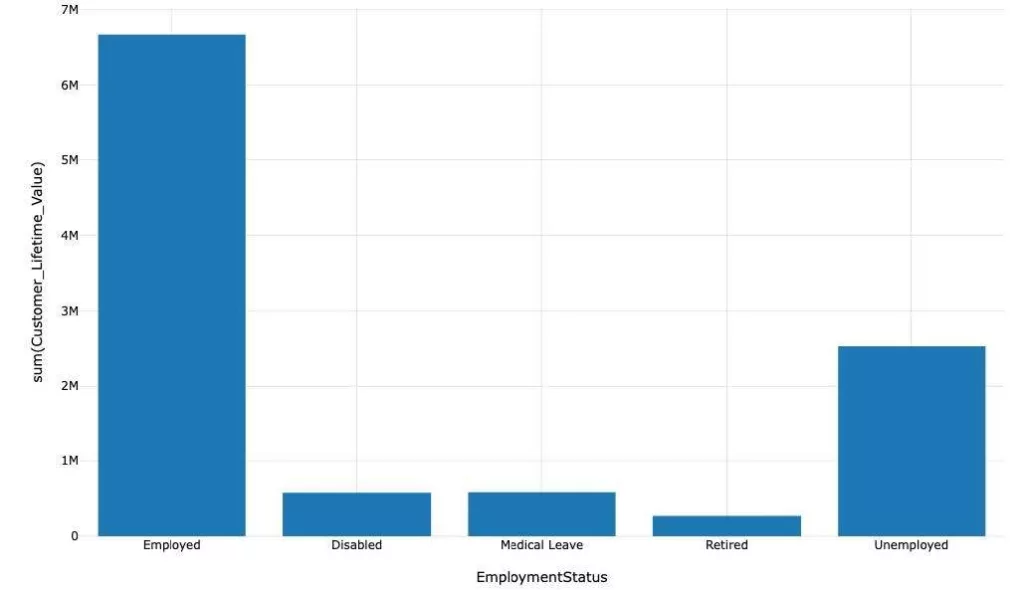

papAI also provides an extensive array of visualization tools, including bar plots and box plots. Let’s explore some visualizations related to CLV based on Monthly premium, Coverage, Employment using bar plots , Scatter and box plots.

There is a Positive Corelation of 39.62 % of MPA with CLV. From scatter plot, it is clearly visible that on Monthly premium , CLV is also Increasing.

Customers who have taken Basic Insurance for their vehicles are more valuable then Extended or Premium Insurance Policy holders.

Employed customers are more valuable than others as compared to Retired, Unemployed, or Disabled Customers.

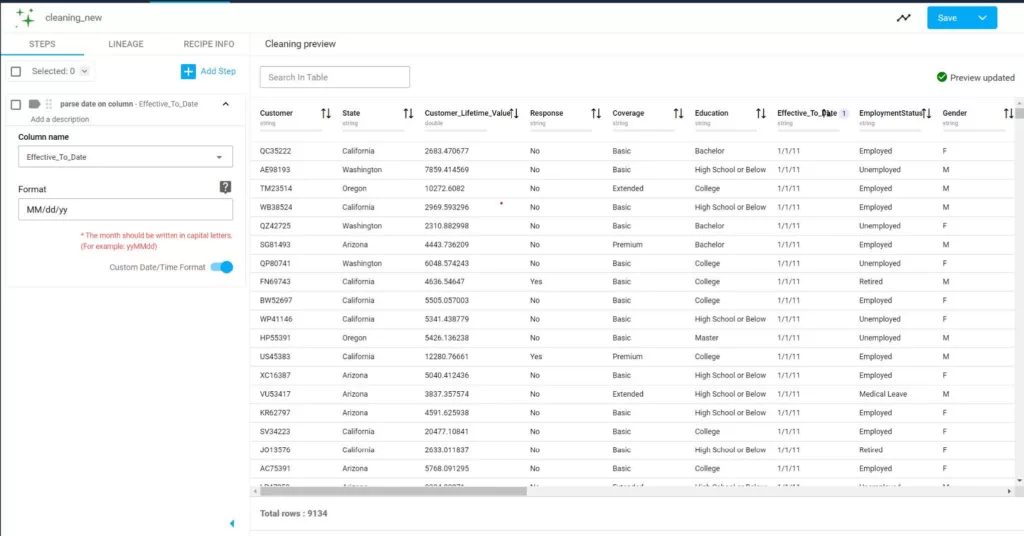

3- Machine Learning

Before training our model, we examined the dataset and discovered that the “Effective to Date” column was not correctly interpreted as a date. To rectify this issue, we used papAI’s Cleaning feature to correctly parse the dates in this column.

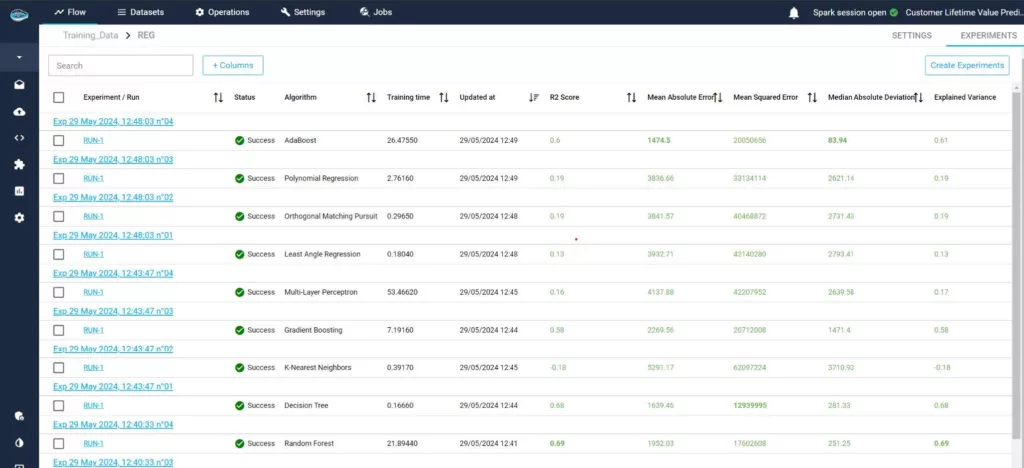

We will employ regression models to predict Customer Lifetime Value (CLV). Regression models are particularly well-suited for this task as they can effectively capture the relationships between the dependent variable (CLV) and a wide array of independent variables.

For this process, we will utilize papAI’s Machine Learning Lab, which offers a wide range of pre-built machine learning algorithms and model selection tools

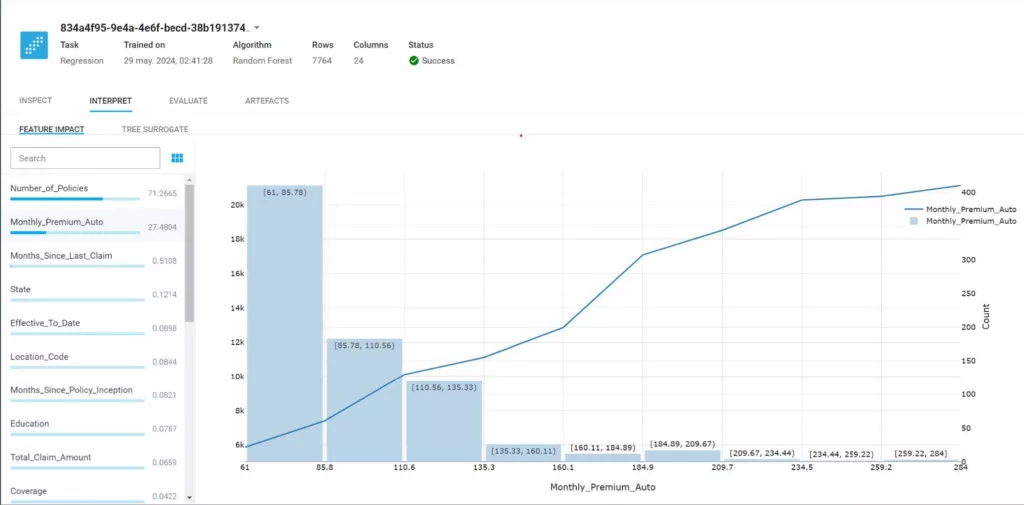

Thanks to the automated model evaluation metrics calculation feature of papAI, we can easily identify and select the best model. In this case, the Random Forest algorithm produced the best results. By clicking on the model, we can access further evaluation and detailed insights

4- Interpretability & Explainability (XAI)

In predicting customer lifetime value, understanding feature importance, counterfactuals, and explanations is essential for interpreting and comprehending the model’s insights. Feature importance involves assessing the impact of various factors like ‘Coverage,’ ‘Employment Status,’ and ‘Total Claim Amount’ on the model’s predictions, helping identify key drivers influencing overall customer value.

In this model, the features “Number_of_Policies” and “Monthly_Premium_Auto” had the most impact on the model.

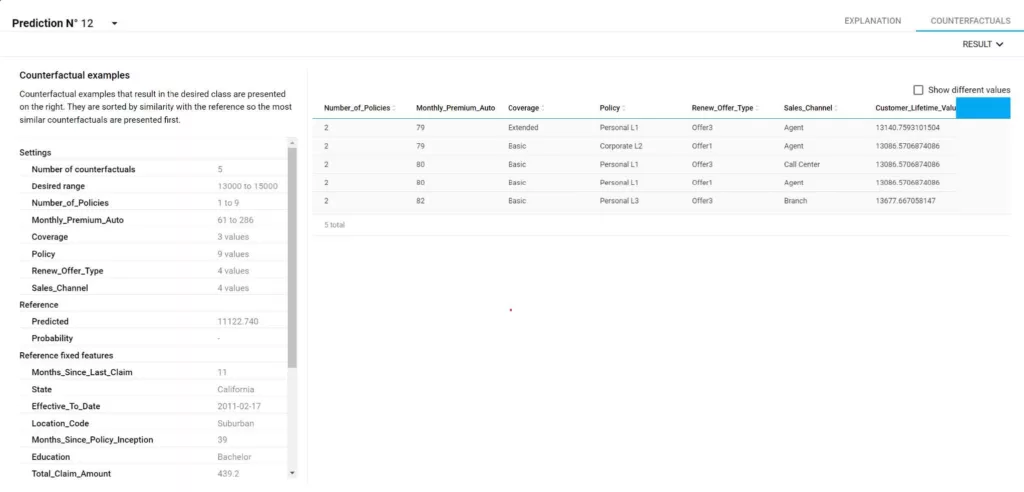

Counterfactuals

papAI’s innovative counterfactual explainer feature is particularly intriguing, as it enables us to understand the impact of each feature on a customer’s spending.

This tool empowers us to determine precisely which values of each feature influence customer spending and suggests adjustments to optimize revenue generation.

This advancement revolutionizes the sales process by equipping sales professionals with actionable insights on the most effective offers to propose to each individual customer.

Conclusion

Concluding our study, we’ve derived several business recommendations based on our data analysis:

A) Targeting educated, married, employed customers residing in urban areas with mid-size vehicles could significantly enhance Customer Lifetime Value (CLV).

B) Failure to promptly resolve customer open complaints and failure to reduce claim amounts may lead to a decrease in Customer Lifetime Value (CLV).

C) Agents contributed approximately 38% of the value to the company, whereas call centers contributed only 20%. Hence, prioritizing agents over call centers for selling auto insurance to customers is advisable.

D) Factors positively influencing CLV include Monthly Premium and Number of Policies, while Open Complaints and Claim Amount have the potential to decrease CLV. These factors should be carefully managed to optimize customer value.

Create your AI-based Tool to Enhance Your Customer Life-Time Value Prediction using papAI

As we have seen, papAI is an all-in-one AI platform designed to help data scientists and business users deploy machine learning projects efficiently. From data preparation to model deployment, papAI covers the entire lifecycle of AI projects

Schedule your demo today. Our team of AI specialists is poised to help you craft a bespoke AI-based solution perfectly tailored to your organization’s unique needs.

CLV stands for Customer Lifetime Value. It’s a metric that estimates the total revenue a business can expect from a single customer throughout their relationship. Understanding CLV helps companies prioritize high-value customers, tailor retention strategies, and allocate marketing budgets more efficiently, ultimately driving long-term profitability and loyalty.

AI can analyze large amounts of customer data like past purchases, engagement patterns, and behavior over time, to make more accurate predictions about a customer’s future value. It adapts as new data comes in, making the insights more reliable and up-to-date.

While regression models like linear or logistic regression are easy to interpret, they often assume a fixed, linear relationship between variables. This can oversimplify the complexity of real customer behavior, especially when different features interact in non-linear or time-sensitive ways. As a result, their CLV predictions may lack accuracy in dynamic, high-volume environments.

Businesses often use machine learning models like regression and decision trees, as well as more advanced approaches like deep learning. These models find hidden patterns in customer behavior to estimate how valuable a customer will be in the future.

Interested in discovering papAI?

Our AI expert team is at your disposal for any questions

Why is Deployment Speed the New 2026 AI Moat?

Why is Deployment Speed the New 2026 AI Moat? The...

Read MoreWe Don’t Just Build AI, We Deliver Measurable Impact

We Don’t Just Build AI, We Deliver Measurable Impact Join...

Read MoreAI’s Role in Translating Complex Defence Documentation

AI’s Role in Translating Complex Defence Documentation The defence sector...

Read More