Life at Datategy : Enzo DAMION Hello everyone, my name...

Read MoreUnleashing the Power of AI: Identifying Potential Customers for Mortgage Loans with papAI

Table of Contents

ToggleThe mortgage sector is crucial to the economy because it helps people fulfill their aspirations of becoming homeowners. Mortgage lenders are always looking for new and creative ways to identify prospective clients who are likely to qualify for a mortgage loan. In a survey conducted by Accenture, 78% of mortgage industry executives agreed that AI and machine learning technologies have the potential to significantly improve the accuracy and efficiency of identifying potential customers for mortgage loans. Artificial intelligence (AI) has become increasingly effective as a tool for processing massive volumes of data and offering insightful analysis.

Find out how papAI can improve the deployment of AI projects in the Banking Sector here.

papAI is one such AI solution that is transforming the mortgage sector. It uses the strength of machine learning algorithms to quickly and effectively identify potential consumers.

Traditional Approaches to Prospect Identification

The methods for discovering prospective clients have greatly changed over the years thanks to developments in technology and data analytics. When determining a borrower’s eligibility in the 1980s, lenders often used conventional techniques including credit checks, income verification, and work history.

With the introduction of credit scoring algorithms and the growing accessibility of electronic data, the 1990s saw a paradigm change. To analyze creditworthiness, lenders started using statistical algorithms, which streamlined the process and reduced manual work.

The growth of internet platforms and the digitalization of financial data throughout the 2000s made it possible to acquire credit histories and automate underwriting more quickly. Automated loan origination systems were also developed around this time, which improved the accuracy of identifying new clients.

The emergence of big data and machine learning in the 2010s allowed lenders to analyze enormous volumes of data, resulting in more precise risk assessments and individualized loan packages. Automation and improved customer experiences have moved to the forefront of consumer identification techniques with the incorporation of AI-powered technologies, such as predictive analytics and natural language processing. In general, approaches for finding new clients have evolved to rely more on technology, make decisions based on data, and emphasize efficiency and personalization.

Finding Potential Consumers for Mortgage Loans: How Important Is It?

In the mortgage market, it is crucial to identify potential customers for mortgage loans. Both mortgage lenders and borrowers can profit from effectively identifying and targeting the appropriate people who are most likely to get approved for a mortgage loan in a number of ways. The following highlights the importance of identifying potential clients:

Increased Efficiency in Loan Processing: By identifying potential clients, the loan processing workflow is made more efficient. Lenders may effectively organize their resources by concentrating on people who fit specific pre-established criteria, ensuring that loan applications from suitable borrowers get quick consideration. Faster turnaround times, more customer satisfaction, and lower expenses related to manual processing are all products of this efficiency.

The Advantages of Using AI for mortgage lenders

1- Enhanced Decision-Making and Risk Assessment

Large volumes of data from many sources, such as credit histories, bank records, and property information, may be analyzed by AI algorithms. AI algorithms analyze this data to produce risk evaluations that are more precise and consistent, enabling lenders to make well-informed lending choices with less human bias. A report by Accenture found that lenders using AI-driven risk assessment models achieved a 50% improvement in credit decision accuracy.

2- Improve Accuracy and Decreased Fraud

Lenders can identify fraudulent activity and reduce the risks connected with loan fraud by using AI algorithms to discover trends and abnormalities in data. AI may spot suspicious behaviors and highlight potentially fraudulent applications by comparing borrower information to previous data, minimizing losses for lenders.

3- Customized Loan Offerings

According to a survey conducted by Fannie Mae, 77% of borrowers expressed a desire for more personalized loan options. Customized loan offerings allow lenders to tailor their products to borrowers’ specific needs, resulting in higher customer satisfaction and increased loan conversion rates. Huge databases may be analyzed by AI algorithms to uncover borrower preferences, risk profiles, and financial requirements. This makes it possible for lenders to provide individualized loan solutions that are catered to the unique needs of individual borrowers, increasing both customer satisfaction and loan conversion rates.

How to choose the best AI solution for your data project?

In this white paper, we provide an overview of AI solutions on the market. We give you concrete guidelines to choose the solution that reinforces the collaboration between your teams.

Case study: How papAI can Identify Potential Customers for Mortgage Loans

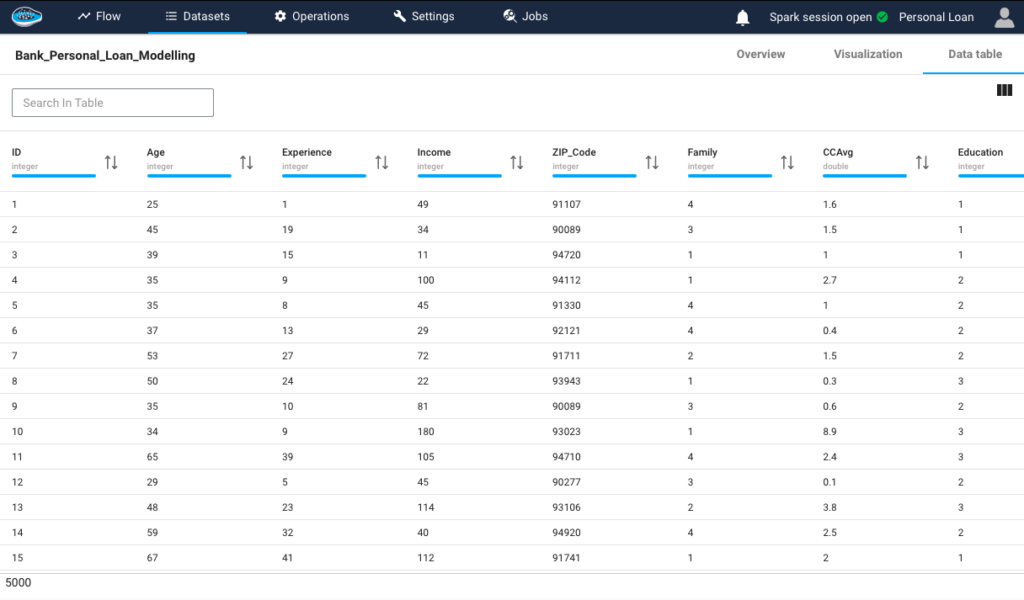

1- Data Presentation

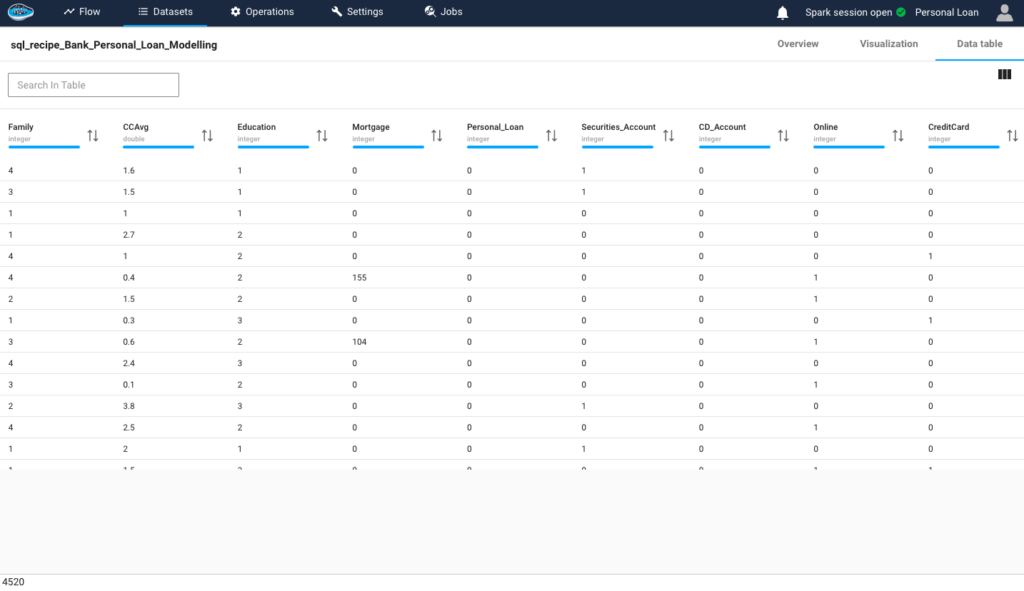

Our dataset contains data on 5000 customers. The data include customer demographic information (age, income, etc.), the customer’s relationship with the bank (mortgage, securities account, etc.), and the customer response to the last personal loan campaign (Personal Loan). Among these 5000 customers, only 480 (= 9.6%) accepted the personal loan that was offered to them in the earlier campaign.

2- Data Analysis and Preparation

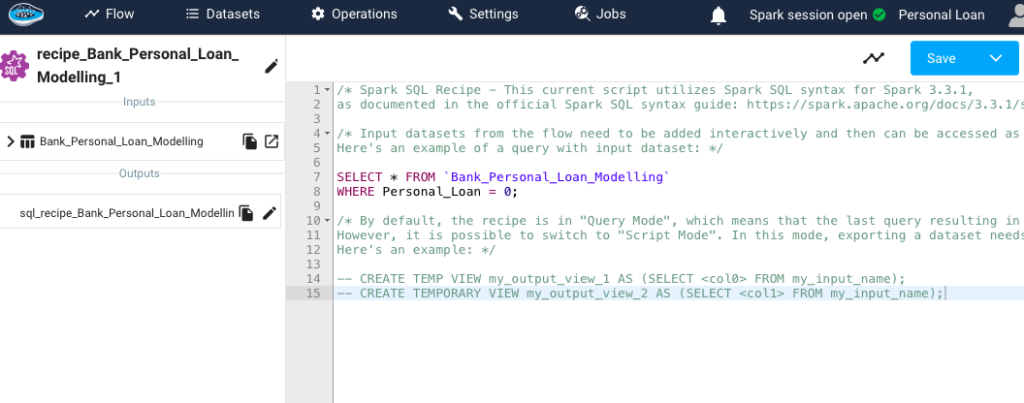

To prepare the data for analysis, we can run multiple general processing operations as the cleaning and the JOIN , but also scripting when we can write pieces of code to be performed on our dataset using papAI recipes interfaces , we can choose between multiple languages like sparkSQL or Python.

We take an example here where we want to get a dataset of the refused loans only using a Spark SQL recipe.

Running this query:

Running this query

We get this dataset of customer with refused loans:

3- Model Training

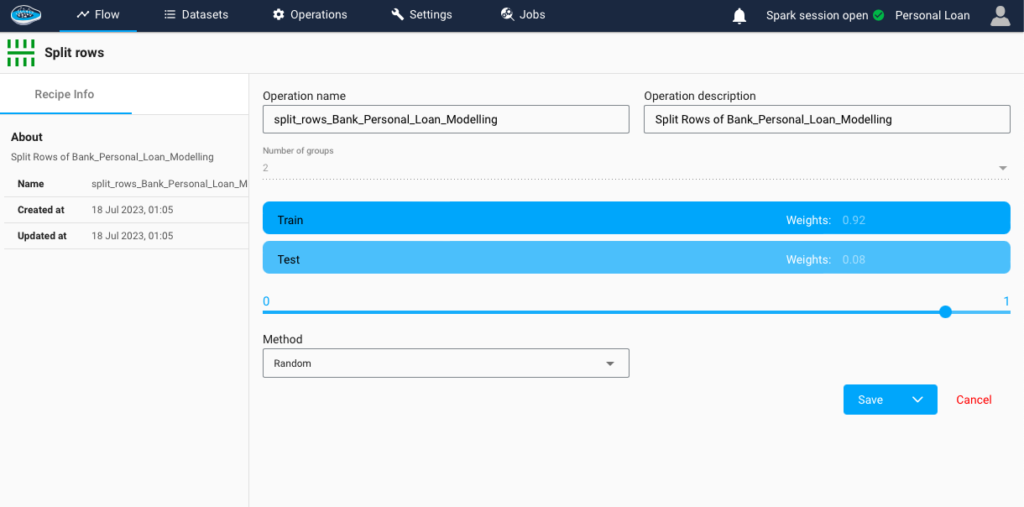

In the training phase, we utilized various models available in papAI Solution to build and evaluate our Personal loan. Papai provides a wide range of machine-learning algorithms and techniques that are suitable for classification tasks. First we want to split our dataset into training and test datasets, using papAI split rows.

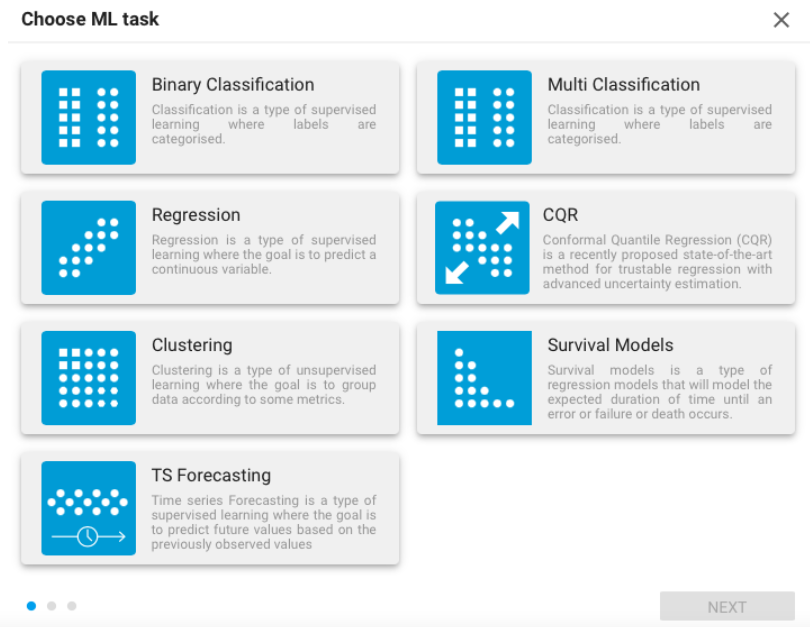

Now we will choose our ML model

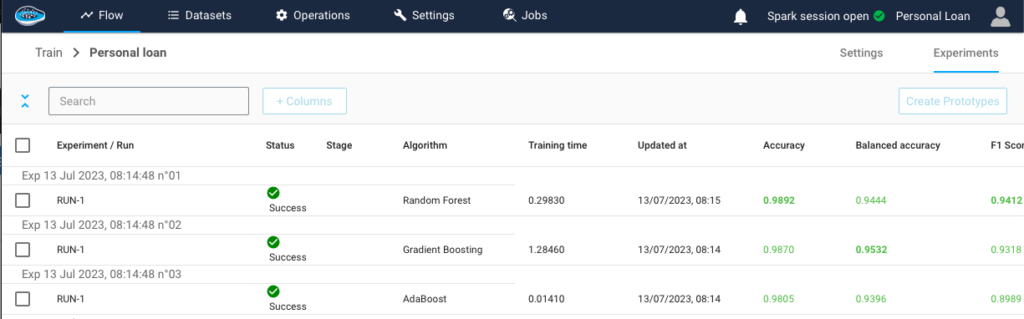

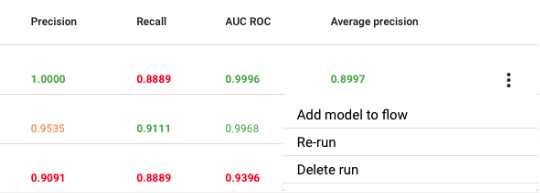

Based on the evaluation results, we selected the model that demonstrated the highest performance. Selecting the model with the best performance ensures that our deployed solution has the highest potential to effectively predict whether the bank should provide a loan to a customer or not.

In this example we notice that the random forest algorithm is the one that performs the best , hence we will deploy it by adding it to the flow.

The model will appear on the flow and we can test its results on our test dataset.

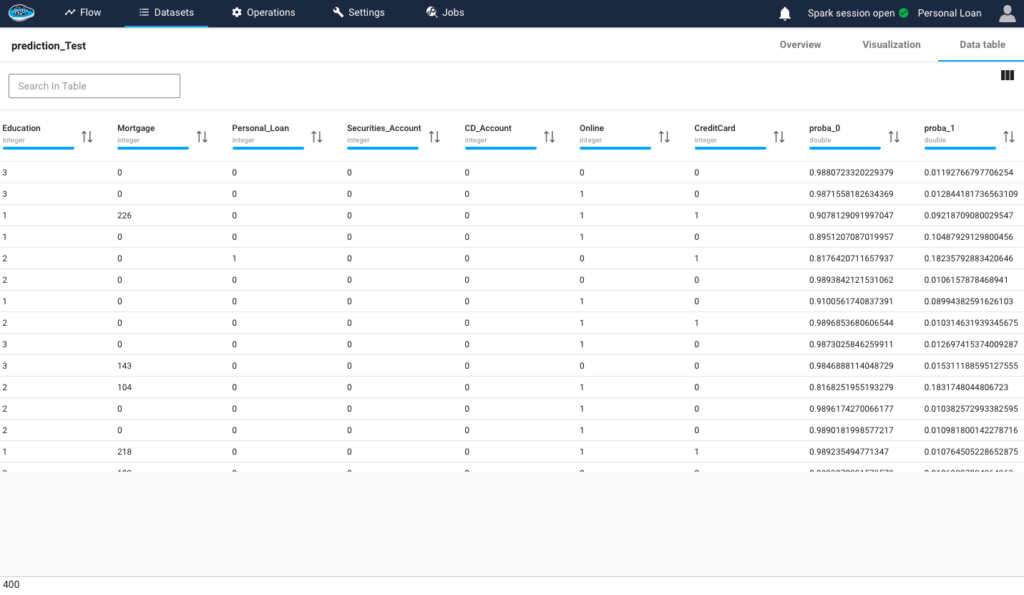

We get our final prediction test predicting the probability of a customer getting a loan from the bank.

4- Interpret the Predicted Outcome

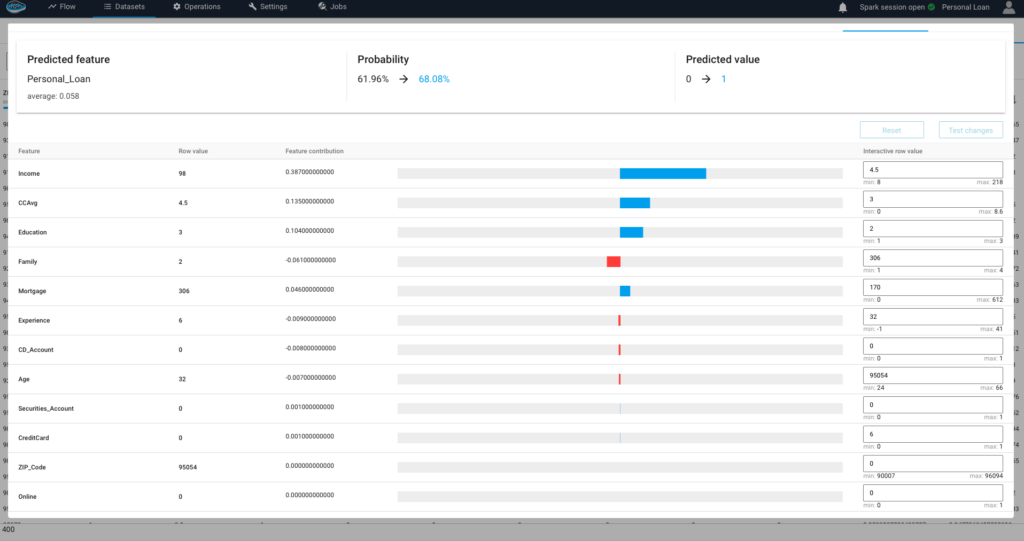

After deploying the model chosen and making the prediction on the test set we can use the counterfactuals artifact proposed by papAI solution which allows us to choose a row and manipulate the different features to see how the model will react depending on each variable as you can see in the figure below, we changed the value of some feature and turned the prediction from 61,96% to 68,08%.

Create your own AI-based tool with papAI solution to deploy, monitor and maintain your AI projects in your Industry

You may utilize AI to make your company’s AI initiatives more comprehensible with the help of papAI solution. Using papAI, you have the option to create your own AI-based tool that is tailored to your specific needs. Modern machine learning methods will significantly improve the accuracy and efficiency of your prediction processes.

Through a process of data mining, cleansing, and visualization that can hasten the deployment of AI projects, papAI solution aids in explaining and making transparent the outcomes. Reserve your demo today. Our team of specialists can assist you in developing a special AI-based product that is tailored to the requirements of your company.

Interested in discovering papAI?

Our commercial team is at your disposal for any questions

Applying NLP for Intelligent Document Analysis using papAI 7

Applying NLP for Intelligent Document Analysis using papAI 7 AI...

Read More“DATATEGY EARLY CAREERS PROGRAM” With Samar CHERNI

“DATATEGY EARLY CAREERS PROGRAM” With Samar CHERNI Hello, my name...

Read MoreAI Origins: Yann LeCun

AI Origins: Yann LeCun Welcome to ”AI Origins “ series....

Read More